Consultation begins on the proposed merger regime

Back in April, the Treasurer announced a significant shift in Australia’s merger clearance system. The Government is moving from the current voluntary notification process to a stricter mandatory notice regime, supported by the Australian Competition and Consumer Commission (ACCC). The recent release of a consultation paper outlines the proposed thresholds for mandatory notifications.

What is the current system?

The Competition and Consumer Act 2010 (Cth) prohibits particular mergers and acquisitions which would, or would be likely to, result in a substantial lessening of competition in the Australian market.

To this end, the ACCC reserves powers to review and block or unwind any such transaction it regards as anti-competitive. We outlined the merger factors weighed up by the ACCC in making any such decision in a previous insight.

Under the existing regime, parties to a merger are not required to notify the ACCC of the proposed transaction and may choose not to do so (at the risk that the ACCC later blocks or unwinds it), but may voluntarily request:

- an informal merger review, whereby the parties may seek the ACCC’s view as to whether the proposed transaction is likely to be considered anti-competitive; or

- merger authorisation, whereby the parties may formally apply to the ACCC to authorise the proposed transaction which, if successful, will exempt the transaction from being subsequently blocked or unwound on the basis that it is anti-competitive.

What is the new regime and proposed thresholds?

Under the new mandatory and suspensory regime, merger parties will be prohibited from completing or otherwise proceeding with certain transactions unless they notify, and until they obtain the approval of, the ACCC.

The consultation paper proposes that, alongside an overarching requirement that the target business or asset must have a “material connection to Australia”, a merger is notifiable if it meets or exceeds the following thresholds:

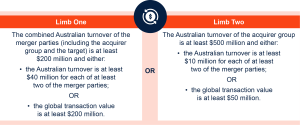

- monetary thresholds, a notification will be required if either of the following limbs are met:

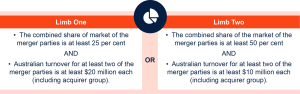

- market concentration thresholds, a notification will be required if either of the following limbs are met:

The merger factors to be considered by the ACCC will also be replaced with various principles (also to be determined), which we understand will include, notably:

- the need for effective market competition, noting the structure and competition conditions (actual and potential) of the relevant markets; and

- the respective positions and economic and financial power of the merger parties’ businesses within the relevant market.

Merger parties who proceed with notifiable mergers without first notifying and obtaining the approval of the ACCC will face significant penalties, and the transaction itself will be voided. Parties to mergers which fall below these thresholds may still voluntarily notify the ACCC.

What happens if you don’t comply?

The last 12 months have seen increases in ACCC penalties, amendments to unfair contract terms laws, the introduction of a designated complaints framework… these merger reforms present the latest in a number of extensive shifts in the Australian competition and consumer law landscape.

Moving forward and how we can help

Businesses will need to ensure that they are properly informed to deal with these reforms and their likely significant implications – which promise not only to capture more deals, but to further colour those deals with greater uncertainty, costs, and time delays.

Macpherson Kelley’s commercial team, with its experience and expertise in competition and consumer law and mergers and acquisitions more broadly, is well placed to answer any queries you have in relation to these reforms.

Please do not hesitate to contact our team for more information.

The information contained in this article is general in nature and cannot be relied on as legal advice nor does it create an engagement. Please contact one of our lawyers listed above for advice about your specific situation.

more

insights

Voluntary dealings with regulators: Practical insights, tips & traps for agribusinesses

A change of director can trigger landholder duty says Victorian Supreme Court

Clarifying the boundaries of trade mark defences: The Fanatics case as a cautionary tale

stay up to date with our news & insights

Consultation begins on the proposed merger regime

Back in April, the Treasurer announced a significant shift in Australia’s merger clearance system. The Government is moving from the current voluntary notification process to a stricter mandatory notice regime, supported by the Australian Competition and Consumer Commission (ACCC). The recent release of a consultation paper outlines the proposed thresholds for mandatory notifications.

What is the current system?

The Competition and Consumer Act 2010 (Cth) prohibits particular mergers and acquisitions which would, or would be likely to, result in a substantial lessening of competition in the Australian market.

To this end, the ACCC reserves powers to review and block or unwind any such transaction it regards as anti-competitive. We outlined the merger factors weighed up by the ACCC in making any such decision in a previous insight.

Under the existing regime, parties to a merger are not required to notify the ACCC of the proposed transaction and may choose not to do so (at the risk that the ACCC later blocks or unwinds it), but may voluntarily request:

- an informal merger review, whereby the parties may seek the ACCC’s view as to whether the proposed transaction is likely to be considered anti-competitive; or

- merger authorisation, whereby the parties may formally apply to the ACCC to authorise the proposed transaction which, if successful, will exempt the transaction from being subsequently blocked or unwound on the basis that it is anti-competitive.

What is the new regime and proposed thresholds?

Under the new mandatory and suspensory regime, merger parties will be prohibited from completing or otherwise proceeding with certain transactions unless they notify, and until they obtain the approval of, the ACCC.

The consultation paper proposes that, alongside an overarching requirement that the target business or asset must have a “material connection to Australia”, a merger is notifiable if it meets or exceeds the following thresholds:

- monetary thresholds, a notification will be required if either of the following limbs are met:

- market concentration thresholds, a notification will be required if either of the following limbs are met:

The merger factors to be considered by the ACCC will also be replaced with various principles (also to be determined), which we understand will include, notably:

- the need for effective market competition, noting the structure and competition conditions (actual and potential) of the relevant markets; and

- the respective positions and economic and financial power of the merger parties’ businesses within the relevant market.

Merger parties who proceed with notifiable mergers without first notifying and obtaining the approval of the ACCC will face significant penalties, and the transaction itself will be voided. Parties to mergers which fall below these thresholds may still voluntarily notify the ACCC.

What happens if you don’t comply?

The last 12 months have seen increases in ACCC penalties, amendments to unfair contract terms laws, the introduction of a designated complaints framework… these merger reforms present the latest in a number of extensive shifts in the Australian competition and consumer law landscape.

Moving forward and how we can help

Businesses will need to ensure that they are properly informed to deal with these reforms and their likely significant implications – which promise not only to capture more deals, but to further colour those deals with greater uncertainty, costs, and time delays.

Macpherson Kelley’s commercial team, with its experience and expertise in competition and consumer law and mergers and acquisitions more broadly, is well placed to answer any queries you have in relation to these reforms.

Please do not hesitate to contact our team for more information.