Accounting experts: Guidelines to Legal Professional Privilege (LPP)

When it comes to litigation, what do accounting experts really need to know about legal professional privilege (LPP)?

Understanding the nuances of LPP is not just a matter of compliance. It can also be a strategic advantage in litigation that serves as a critical safeguard for clients’ interests and ensures your credibility as an expert witness before the court. For accountants engaged as experts, it is essential to have thorough understanding of how LPP operates in your communications with lawyers and their clients.

What is legal professional privilege?

LPP is a common law and statutory right that protects people against being compelled to provide information or documents that are exchanged between a lawyer and client or third party (e.g. accounting experts) for the dominant purpose of giving or receiving legal advice, or for use in existing or anticipated litigation.

The overarching purpose of the LPP immunity is to protect a client who is receiving legal advice without fear of it later being used against them, thereby instilling confidence in the legal system.

In short, a communication may be privileged if it is:

- confidential; and

- made in the course of a professional relationship between a lawyer and client; and

- between the client and lawyer for the dominant purpose of seeking or providing legal advice; or

- between a third party (e.g. accountant) and a lawyer or client for the dominant purpose of use in, or in relation to, existing or anticipated legal proceedings.

In the world of litigation, accountants are commonly engaged by lawyers to produce an expert report for the purpose of informing the quantum of a client’s actual or soon to be claim, or for the purpose of advancing legal proceedings which are already on foot.

In that case, a communication which may ordinarily attract LPP may not be privileged in Queensland if it consists of a statement or report of an expert called as a witness in litigation (see rule 212(2) of the Uniform Civil Procedure Rules 1999 (Qld).

So what does that mean for you, your communications with the lawyer and the documents that are exchanged between you?

Examples of privileged communications

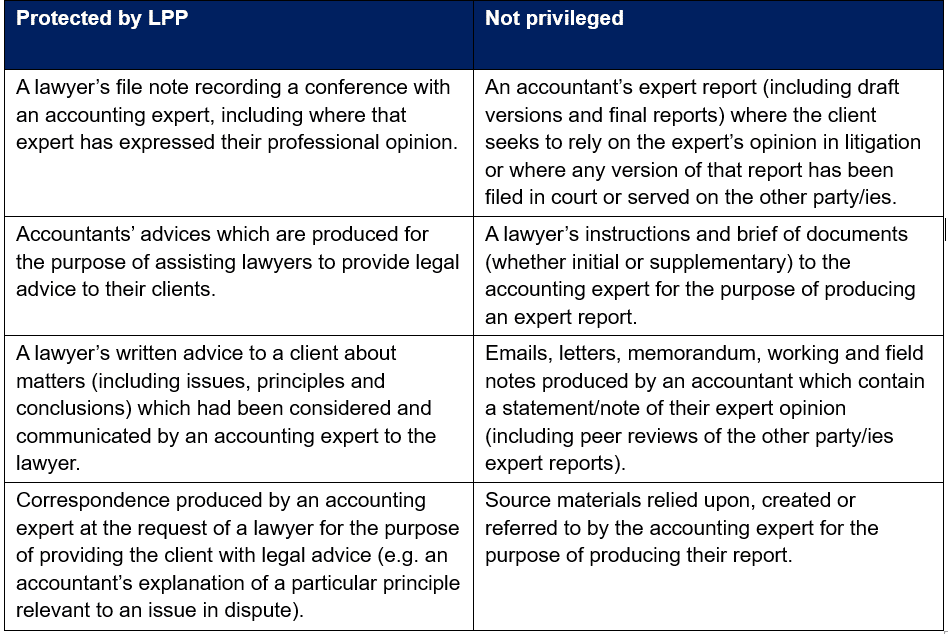

As a guiding framework, examples of common communications and documents in these situations can be categorised as follows:

Further examples of communication that are not privileged

There are a couple more instances relevant to accounting experts where communications are not actually privileged.

- An accounting expert’s request for further information, clarification, documents or other related material necessary to inform their opinion or clarify the scope of their engagement (including lawyers’ responses to the same).

- Where an accounting expert’s advice, statement, opinion or report is relied on in a legal proceeding, all communications between the expert and the lawyer are unlikely to be privileged.

Understanding the nuance of communication that are or are not privileged can have a serious impact on negotiations and litigation disputes.

Waiver of LPP

That said, it is important to bear in mind that LPP may be waived or lost entirely where parties to such communications conduct themselves in a way which is inconsistent with maintaining privilege.

The principle underlying this waiver is simply that it would be unfair for a party to ‘pick and choose’ when the veil of LPP comes into play, particularly after such party has either intentionally or inadvertently disclosed the material in question.

For example, LPP may be waived over a communication or document where a party has:

- Failed to maintain confidentiality of those communications (e.g. providing an accounting expert’s report to the client’s insurer, where the insurer has not accepted the client’s claim).

- Disclosed a privileged communication, whether entirely or partially (e.g. referring to privileged legal advices in open correspondence).

- Made a statement or given evidence in court which refers to communications (both oral and in writing) that would have ordinarily attracted LPP (e.g. accounting experts giving evidence of conversations had with lawyers and clients in conference, which the clients’ legal advisors fail to object to).

Key questions to ask yourself

While it can be challenging to navigate the minefield that is LPP, it can be helpful at first instance to ask yourself the following questions:

- Will my communication remain confidential if I send it onto said party? Are the contents of what I am sending not widely known?

- Am I sending or receiving this communication in my capacity as an expert witness in the proceeding?

- Was the main purpose of this communication to provide advice in relation to a current or anticipated litigation?

- Is this communication or document something I have or will rely on in forming my opinion or producing my expert report?

- Is there any chance that the content of my communication and/or the person receiving my communication could be inconsistent with maintaining privilege?

If in doubt, err on the side of caution by treating the communication/document as if it is not privileged because it can be near impossible to claim it back.

Contact our Litigation and Dispute Resolution team for further advice

Still unsure? Get in touch with our lawyers today so we can help you get to the bottom of it.

The information contained in this article is general in nature and cannot be relied on as legal advice nor does it create an engagement. Please contact one of our lawyers listed above for advice about your specific situation.

more

insights

Implied contract terms: Court of Appeal confirms no implied right for hospital to terminate long term emergency services agreement

Can a respondent claim the Companion Principle? Defending a tech company’s confidential information in court

A change of director can trigger landholder duty says Victorian Supreme Court

stay up to date with our news & insights

Accounting experts: Guidelines to Legal Professional Privilege (LPP)

When it comes to litigation, what do accounting experts really need to know about legal professional privilege (LPP)?

Understanding the nuances of LPP is not just a matter of compliance. It can also be a strategic advantage in litigation that serves as a critical safeguard for clients’ interests and ensures your credibility as an expert witness before the court. For accountants engaged as experts, it is essential to have thorough understanding of how LPP operates in your communications with lawyers and their clients.

What is legal professional privilege?

LPP is a common law and statutory right that protects people against being compelled to provide information or documents that are exchanged between a lawyer and client or third party (e.g. accounting experts) for the dominant purpose of giving or receiving legal advice, or for use in existing or anticipated litigation.

The overarching purpose of the LPP immunity is to protect a client who is receiving legal advice without fear of it later being used against them, thereby instilling confidence in the legal system.

In short, a communication may be privileged if it is:

- confidential; and

- made in the course of a professional relationship between a lawyer and client; and

- between the client and lawyer for the dominant purpose of seeking or providing legal advice; or

- between a third party (e.g. accountant) and a lawyer or client for the dominant purpose of use in, or in relation to, existing or anticipated legal proceedings.

In the world of litigation, accountants are commonly engaged by lawyers to produce an expert report for the purpose of informing the quantum of a client’s actual or soon to be claim, or for the purpose of advancing legal proceedings which are already on foot.

In that case, a communication which may ordinarily attract LPP may not be privileged in Queensland if it consists of a statement or report of an expert called as a witness in litigation (see rule 212(2) of the Uniform Civil Procedure Rules 1999 (Qld).

So what does that mean for you, your communications with the lawyer and the documents that are exchanged between you?

Examples of privileged communications

As a guiding framework, examples of common communications and documents in these situations can be categorised as follows:

Further examples of communication that are not privileged

There are a couple more instances relevant to accounting experts where communications are not actually privileged.

- An accounting expert’s request for further information, clarification, documents or other related material necessary to inform their opinion or clarify the scope of their engagement (including lawyers’ responses to the same).

- Where an accounting expert’s advice, statement, opinion or report is relied on in a legal proceeding, all communications between the expert and the lawyer are unlikely to be privileged.

Understanding the nuance of communication that are or are not privileged can have a serious impact on negotiations and litigation disputes.

Waiver of LPP

That said, it is important to bear in mind that LPP may be waived or lost entirely where parties to such communications conduct themselves in a way which is inconsistent with maintaining privilege.

The principle underlying this waiver is simply that it would be unfair for a party to ‘pick and choose’ when the veil of LPP comes into play, particularly after such party has either intentionally or inadvertently disclosed the material in question.

For example, LPP may be waived over a communication or document where a party has:

- Failed to maintain confidentiality of those communications (e.g. providing an accounting expert’s report to the client’s insurer, where the insurer has not accepted the client’s claim).

- Disclosed a privileged communication, whether entirely or partially (e.g. referring to privileged legal advices in open correspondence).

- Made a statement or given evidence in court which refers to communications (both oral and in writing) that would have ordinarily attracted LPP (e.g. accounting experts giving evidence of conversations had with lawyers and clients in conference, which the clients’ legal advisors fail to object to).

Key questions to ask yourself

While it can be challenging to navigate the minefield that is LPP, it can be helpful at first instance to ask yourself the following questions:

- Will my communication remain confidential if I send it onto said party? Are the contents of what I am sending not widely known?

- Am I sending or receiving this communication in my capacity as an expert witness in the proceeding?

- Was the main purpose of this communication to provide advice in relation to a current or anticipated litigation?

- Is this communication or document something I have or will rely on in forming my opinion or producing my expert report?

- Is there any chance that the content of my communication and/or the person receiving my communication could be inconsistent with maintaining privilege?

If in doubt, err on the side of caution by treating the communication/document as if it is not privileged because it can be near impossible to claim it back.

Contact our Litigation and Dispute Resolution team for further advice

Still unsure? Get in touch with our lawyers today so we can help you get to the bottom of it.