Australia’s Unfair Contract Terms regime changes significantly

This holiday season has seen major changes to the trade and compliance space that require immediate action from businesses. So, the team at Macpherson Kelley is making sure you’ve made a list and you’re checking it twice!

We’ll be releasing a series of accessible guides and articles on what your business needs to do to stay on Santa’s nice list this year – with the help and guidance of our trade and compliance team.

Further to our recent article on unfair contract terms, Australia’s Unfair Contract Terms regime (UCT) has been significantly expanded in respect of ‘small businesses’. The changes were passed by Parliament on 28 October 2022, received Royal Assent on 9 November 2022 and will come into effect on 9 November 2023.

The changes are monumental in terms of the penalties and scope of what is considered an “unfair” term and will be therefore illegal. This will have significant impacts on many businesses – both in terms of the time it will take to review and amend contracts but also the consequence for not doing so.

We’ve detailed the changes you can expect and the many action items your business will need to consider to remain compliant.

What has changed?

The key changes brought in by the amendments to the Competition and Consumer Act 2010 (Cth) (CCA) are:

- wider scope of application – the UCT laws apply to significantly more businesses and transactions;

- wider scope of consequences resulting from a breach – the Courts have been given significantly more broad and far-reaching powers; and

- higher penalties – a five-fold increase, and more.

Unfair contract terms: Application

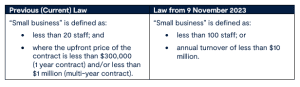

The definition of a “small business” has changed significantly which means that the legislation relating to unfair contract terms will affect a wider group of businesses – perhaps even some that don’t currently categorise themselves as a small business.

The definitions are broken down below.

Unfair contract terms: Consequences of breach

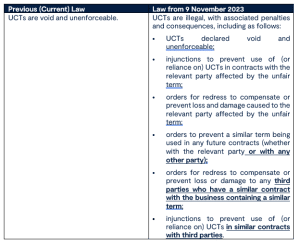

From 9 November 2023 UCTs will be illegal, so now is the time to review your contracts as they will take a while to review and amend. There have been changes to penalties and consequences for non-compliance which are detailed below.

Importantly, many of these additional penalties can be sought at any time within 6 years from the date the contract term was declared to be an UCT.

Many of these orders will also bind a person affected by the order, even if that person was NOT a party to the original proceedings (eg, a subsequent purchaser of the business).

Unfair contract terms: Penalties

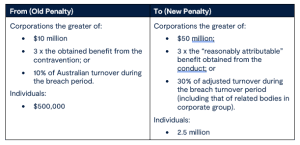

Changes also apply to penalties and this is where businesses will see a stark increase. Penalties for non-compliance are five times greater from 10 November 2022, so businesses cannot afford to ignore the change.

Similar conceptual amendments have also been made to the Australian Securities and Investments Commission Act 2001 (ASIC Act) regarding UCTs in contracts for financial products, although the penalty regime is different.

The existing regime prohibiting unfair terms in standard form CONSUMER contracts (in force since 2016) also remains.

Why the change?

The ongoing emphasis on consumer and small-business protection. The ACCC has commented that the purpose of the change to the UCT regime is to improve small business and consumer confidence when entering into or renewing standard form contracts in the future, and that they will not be taken advantage of.

The change is important to protect consumers and small businesses where there may be an imbalance in bargaining power.

What is an unfair term?

For a term to be “unfair” it must:

- cause a significant imbalance in the parties’ rights and obligations;

- not be reasonably necessary to protect the legitimate interests of the party advantaged by the term; and

- cause a financial or other detriment (such as delay) to a small business if it were relied on.

In deciding whether a term is unfair, a court will consider how transparent the term is, as well as the overall rights and obligations of each party under the contract.

A term will be transparent if it is:

- in plain language;

- legible;

- presented clearly; and

- readily available to any part affected by the term.

What do businesses need to do?

- Do you use standard form contracts with your ‘small business’ customers?

If yes, you have 12 months to review and update your standard form contracts to ensure compliance. Macpherson Kelley’s Trade team can complete the review and update to be compliant with the new changes to the UCT regime, and advise you on clauses of potential concern or challenge.

- Are you a ‘small business’ being asked to enter into a standard form contract with your vendor / supplier?

If yes, we can review these contracts and advise you if there are any unfair contract terms included.

Need more information or assistance?

For further information about the UCT regime, and a review of your contracts, please contact one of our experts.

The information contained in this article is general in nature and cannot be relied on as legal advice nor does it create an engagement. Please contact one of our lawyers listed above for advice about your specific situation.

more

insights

Voluntary dealings with regulators: Practical insights, tips & traps for agribusinesses

A change of director can trigger landholder duty says Victorian Supreme Court

Clarifying the boundaries of trade mark defences: The Fanatics case as a cautionary tale

stay up to date with our news & insights

Australia’s Unfair Contract Terms regime changes significantly

This holiday season has seen major changes to the trade and compliance space that require immediate action from businesses. So, the team at Macpherson Kelley is making sure you’ve made a list and you’re checking it twice!

We’ll be releasing a series of accessible guides and articles on what your business needs to do to stay on Santa’s nice list this year – with the help and guidance of our trade and compliance team.

Further to our recent article on unfair contract terms, Australia’s Unfair Contract Terms regime (UCT) has been significantly expanded in respect of ‘small businesses’. The changes were passed by Parliament on 28 October 2022, received Royal Assent on 9 November 2022 and will come into effect on 9 November 2023.

The changes are monumental in terms of the penalties and scope of what is considered an “unfair” term and will be therefore illegal. This will have significant impacts on many businesses – both in terms of the time it will take to review and amend contracts but also the consequence for not doing so.

We’ve detailed the changes you can expect and the many action items your business will need to consider to remain compliant.

What has changed?

The key changes brought in by the amendments to the Competition and Consumer Act 2010 (Cth) (CCA) are:

- wider scope of application – the UCT laws apply to significantly more businesses and transactions;

- wider scope of consequences resulting from a breach – the Courts have been given significantly more broad and far-reaching powers; and

- higher penalties – a five-fold increase, and more.

Unfair contract terms: Application

The definition of a “small business” has changed significantly which means that the legislation relating to unfair contract terms will affect a wider group of businesses – perhaps even some that don’t currently categorise themselves as a small business.

The definitions are broken down below.

Unfair contract terms: Consequences of breach

From 9 November 2023 UCTs will be illegal, so now is the time to review your contracts as they will take a while to review and amend. There have been changes to penalties and consequences for non-compliance which are detailed below.

Importantly, many of these additional penalties can be sought at any time within 6 years from the date the contract term was declared to be an UCT.

Many of these orders will also bind a person affected by the order, even if that person was NOT a party to the original proceedings (eg, a subsequent purchaser of the business).

Unfair contract terms: Penalties

Changes also apply to penalties and this is where businesses will see a stark increase. Penalties for non-compliance are five times greater from 10 November 2022, so businesses cannot afford to ignore the change.

Similar conceptual amendments have also been made to the Australian Securities and Investments Commission Act 2001 (ASIC Act) regarding UCTs in contracts for financial products, although the penalty regime is different.

The existing regime prohibiting unfair terms in standard form CONSUMER contracts (in force since 2016) also remains.

Why the change?

The ongoing emphasis on consumer and small-business protection. The ACCC has commented that the purpose of the change to the UCT regime is to improve small business and consumer confidence when entering into or renewing standard form contracts in the future, and that they will not be taken advantage of.

The change is important to protect consumers and small businesses where there may be an imbalance in bargaining power.

What is an unfair term?

For a term to be “unfair” it must:

- cause a significant imbalance in the parties’ rights and obligations;

- not be reasonably necessary to protect the legitimate interests of the party advantaged by the term; and

- cause a financial or other detriment (such as delay) to a small business if it were relied on.

In deciding whether a term is unfair, a court will consider how transparent the term is, as well as the overall rights and obligations of each party under the contract.

A term will be transparent if it is:

- in plain language;

- legible;

- presented clearly; and

- readily available to any part affected by the term.

What do businesses need to do?

- Do you use standard form contracts with your ‘small business’ customers?

If yes, you have 12 months to review and update your standard form contracts to ensure compliance. Macpherson Kelley’s Trade team can complete the review and update to be compliant with the new changes to the UCT regime, and advise you on clauses of potential concern or challenge.

- Are you a ‘small business’ being asked to enter into a standard form contract with your vendor / supplier?

If yes, we can review these contracts and advise you if there are any unfair contract terms included.

Need more information or assistance?

For further information about the UCT regime, and a review of your contracts, please contact one of our experts.