Climate related financial disclosures are coming!

A new Bill has been introduced to parliament – and it has been deemed one of the biggest changes to company climate reporting in a generation.

This reform, if and when passed, imposes mandatory climate related financial disclosures for a range of large to smaller entities, with a staggered timetable. These changes are expected to impose a significant financial burden on all reporting entities, with some commentators estimating it may increase regulatory costs by over $1 million for larger entities (per year per entity, averaged over ten years)!

While not relevant to this update, the other reform introduced by the Bill is in relation to Australia’s financial market infrastructure.

The Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024 (Bill) had its first reading in parliament on 27 March 2024. It was subsequently introduced to the Senate and read on 24 June 2024, replacing the earlier draft released on 12 January 2024.

What is climate-related financial disclosure?

If this Bill is passed, it would mean that a large proportion of companies would be required to disclose how climate change could affect the company’s financial performance, operations and sustainability.

Is there a need for these mandatory financial disclosures?

There has been a growing consumer interest in sustainable and environmental practices. This has led to the concern that businesses were making sustainable claims which were not substantiated. As an example, last year the ACCC reviewed 247 businesses and found that a staggering 57% had made concerning claims about their environmental or sustainability practices.

Are there existing climate related disclosure frameworks?

There are existing frameworks that companies can adopt in Australia. However, as the Treasury stated in its policy impact analysis the “..existing climate risk disclosures are often inconsistent or contain insufficient information to support decision-making. Investors also note the lack of standardisation makes disclosures difficult to compare..”

In 2021 at the UN Climate Change Conference in Glasgow, the International Sustainability Standards Board (ISSB) was formed to develop, in the public interest, a comprehensive global baseline of sustainability disclosures for the financial markets. The idea of this global baseline is supported by G20 leaders (which includes Australia).

The Australian Accounting Standards Board (AASB) has drafted the Australian sustainability reporting standards, and these should be completed later this year. The proposed AASB sustainability standards should align with the ISSB standards as much as possible, with modifications for the Australian context.

Which entities would be required to report?

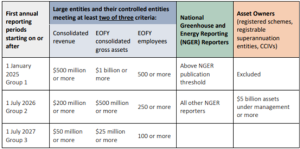

There are three groups of entities which would be required to report, with a staggered approach being adopted:

- large entities required to report under Chapter 2M of the Corporations Act;

- entities required to report under the National Greenhouse and Energy Reporting Act 2007 (Cth); and

- asset owners with over $5 billion in assets under management.

The table below shows the entities which would be required to report as well as the proposed timeframe, if the current Bill is passed.

Source: Department of Parliamentary Services, ‘Bills Digest No. 68, 2023-24: Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024’ dated 14 May 2024.

What will these companies be required to do?

The captured companies will be required to produce a sustainability report which will form part of the usual annual reports of a company. The sustainability report will need to contain a climate statement for the year and a directors’ declaration that the sustainability report complies with the Bill. It is expected that the climate statement will need to contain details of the entity’s:

- material climate risks and opportunities faced by the entity;

- governance process, strategy and risk management plan to manage climate-related risks and opportunities; and

- climate metrics and targets, including the entity’s Scope 1, 2 and 3 greenhouse gas emissions.

The Scope 1 greenhouse gas emissions are direct greenhouse gas emissions that occur from sources that are owned or controlled by an entity. Scope 2 greenhouse gas emissions are emissions from the generation of purchased or acquired electricity, steam, heating or cooling consumed by an entity that physically occur at the facility where the electricity is generated. Scope 3 greenhouse gas emissions are indirect greenhouse gas emissions (not otherwise included in Scope 2 emissions) that occur in the value chain of an entity, including both upstream and downstream emissions and financed emissions.

In the current Bill’s drafting, this sustainability report will need to be audited in the same manner as an annual financial report and it will also need to align with the AASB standards.

What happens next?

The Bill has yet to be passed by both Houses, so the Bill may be revised again prior to implementation. The Senate Economics Legislation Committee has supported the Bill’s passage. The Coalition, independents and the Greens had sought amendments, but these were rejected. However, there seems to be little appetite to vary the thresholds for reporting entities.

Notwithstanding, ASIC is already encouraging companies to start putting into place the systems, processes and governance practices that will be required to meet new climate reporting requirements.

We will keep you updated on the Bill’s progress.

In the meantime, please contact Macpherson Kelley’s ESG Team if you have questions or require expert assistance.

The information contained in this article is general in nature and cannot be relied on as legal advice nor does it create an engagement. Please contact one of our lawyers listed above for advice about your specific situation.

more

insights

Voluntary dealings with regulators: Practical insights, tips & traps for agribusinesses

A change of director can trigger landholder duty says Victorian Supreme Court

Clarifying the boundaries of trade mark defences: The Fanatics case as a cautionary tale

stay up to date with our news & insights

Climate related financial disclosures are coming!

A new Bill has been introduced to parliament – and it has been deemed one of the biggest changes to company climate reporting in a generation.

This reform, if and when passed, imposes mandatory climate related financial disclosures for a range of large to smaller entities, with a staggered timetable. These changes are expected to impose a significant financial burden on all reporting entities, with some commentators estimating it may increase regulatory costs by over $1 million for larger entities (per year per entity, averaged over ten years)!

While not relevant to this update, the other reform introduced by the Bill is in relation to Australia’s financial market infrastructure.

The Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024 (Bill) had its first reading in parliament on 27 March 2024. It was subsequently introduced to the Senate and read on 24 June 2024, replacing the earlier draft released on 12 January 2024.

What is climate-related financial disclosure?

If this Bill is passed, it would mean that a large proportion of companies would be required to disclose how climate change could affect the company’s financial performance, operations and sustainability.

Is there a need for these mandatory financial disclosures?

There has been a growing consumer interest in sustainable and environmental practices. This has led to the concern that businesses were making sustainable claims which were not substantiated. As an example, last year the ACCC reviewed 247 businesses and found that a staggering 57% had made concerning claims about their environmental or sustainability practices.

Are there existing climate related disclosure frameworks?

There are existing frameworks that companies can adopt in Australia. However, as the Treasury stated in its policy impact analysis the “..existing climate risk disclosures are often inconsistent or contain insufficient information to support decision-making. Investors also note the lack of standardisation makes disclosures difficult to compare..”

In 2021 at the UN Climate Change Conference in Glasgow, the International Sustainability Standards Board (ISSB) was formed to develop, in the public interest, a comprehensive global baseline of sustainability disclosures for the financial markets. The idea of this global baseline is supported by G20 leaders (which includes Australia).

The Australian Accounting Standards Board (AASB) has drafted the Australian sustainability reporting standards, and these should be completed later this year. The proposed AASB sustainability standards should align with the ISSB standards as much as possible, with modifications for the Australian context.

Which entities would be required to report?

There are three groups of entities which would be required to report, with a staggered approach being adopted:

- large entities required to report under Chapter 2M of the Corporations Act;

- entities required to report under the National Greenhouse and Energy Reporting Act 2007 (Cth); and

- asset owners with over $5 billion in assets under management.

The table below shows the entities which would be required to report as well as the proposed timeframe, if the current Bill is passed.

Source: Department of Parliamentary Services, ‘Bills Digest No. 68, 2023-24: Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024’ dated 14 May 2024.

What will these companies be required to do?

The captured companies will be required to produce a sustainability report which will form part of the usual annual reports of a company. The sustainability report will need to contain a climate statement for the year and a directors’ declaration that the sustainability report complies with the Bill. It is expected that the climate statement will need to contain details of the entity’s:

- material climate risks and opportunities faced by the entity;

- governance process, strategy and risk management plan to manage climate-related risks and opportunities; and

- climate metrics and targets, including the entity’s Scope 1, 2 and 3 greenhouse gas emissions.

The Scope 1 greenhouse gas emissions are direct greenhouse gas emissions that occur from sources that are owned or controlled by an entity. Scope 2 greenhouse gas emissions are emissions from the generation of purchased or acquired electricity, steam, heating or cooling consumed by an entity that physically occur at the facility where the electricity is generated. Scope 3 greenhouse gas emissions are indirect greenhouse gas emissions (not otherwise included in Scope 2 emissions) that occur in the value chain of an entity, including both upstream and downstream emissions and financed emissions.

In the current Bill’s drafting, this sustainability report will need to be audited in the same manner as an annual financial report and it will also need to align with the AASB standards.

What happens next?

The Bill has yet to be passed by both Houses, so the Bill may be revised again prior to implementation. The Senate Economics Legislation Committee has supported the Bill’s passage. The Coalition, independents and the Greens had sought amendments, but these were rejected. However, there seems to be little appetite to vary the thresholds for reporting entities.

Notwithstanding, ASIC is already encouraging companies to start putting into place the systems, processes and governance practices that will be required to meet new climate reporting requirements.

We will keep you updated on the Bill’s progress.

In the meantime, please contact Macpherson Kelley’s ESG Team if you have questions or require expert assistance.