Climate related financial disclosures are here

Businesses will soon be required to report on their company’s environmental impact following the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Act 2024 (Act) became law on 17 September 2024.

The Act, which we covered in more detail in an earlier insight article, amends the Corporations Act 2001 (Cth) (Corporations Act) and the Australian Securities and Investments Commission Act 2001 (Cth). Schedule 4 of the Act introduces key reforms, including mandatory climate-related financial disclosures for large businesses and financial institutions in Australia.

When will climate reporting come into effect?

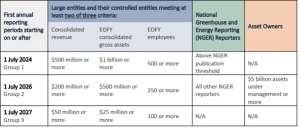

The mandatory climate reporting provisions within this legislation will start coming into effect from 1 January 2025 for Group 1 entities. Group 1 entities are entities that satisfy at least two of the following:

- the consolidated revenue for the financial year of the entity and the entities it controls (if any) is $500 million or more;

- the value of the consolidated gross assets at the end of the financial year of the entity and the entities it controls (if any) is $1 billion or more;

- the entity and the entities it controls (if any) have 500 or more employees at the end of the financial year.

What sort of climate reporting will I need to provide?

The provisions require large entities to prepare a sustainability report in line with the standards set by the Australian Accounting Standards Board (AASB), using the International Sustainability Standards Board (ISSB)’s framework as a baseline. The focus of these disclosures is on financial materiality, emphasising the financial impacts of climate-related risks and opportunities on an entity’s performance and prospects.

Three years for entities to make substantive provisions

The Act contains transitional arrangements and will not come fully into force until 1 July 2027. The first three years of these amendments to the Corporations Act, the directors are required to declare that the entity has taken reasonable steps to ensure the substantive provisions of the sustainability report are in accordance with the Corporations Act. After the three years has passed, the directors will need to declare whether the substantive provisions of the sustainability report are in accordance with the Corporations Act.

Group 2 and 3 definitions

The commencement of reporting obligations for Group 2 and Group 3 entities start, respectively, on 1 July 2026 and 1 July 2027. For their definitions see the table below:

Businesses must prepare for climate compliance

The adoption of the Act marks a significant shift and requires businesses to actively prepare for compliance with the new climate reporting standards starting from 2025.

Please contact Macpherson Kelley’s ESG Team if you have questions or require expert assistance.

The information contained in this article is general in nature and cannot be relied on as legal advice nor does it create an engagement. Please contact one of our lawyers listed above for advice about your specific situation.

more

insights

Navigating Australia’s new trade mark regulations

Automated Decision Making: Business obligations, risks and strategic responses to new reforms

Voluntary dealings with regulators: Practical insights, tips & traps for agribusinesses

stay up to date with our news & insights

Climate related financial disclosures are here

Businesses will soon be required to report on their company’s environmental impact following the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Act 2024 (Act) became law on 17 September 2024.

The Act, which we covered in more detail in an earlier insight article, amends the Corporations Act 2001 (Cth) (Corporations Act) and the Australian Securities and Investments Commission Act 2001 (Cth). Schedule 4 of the Act introduces key reforms, including mandatory climate-related financial disclosures for large businesses and financial institutions in Australia.

When will climate reporting come into effect?

The mandatory climate reporting provisions within this legislation will start coming into effect from 1 January 2025 for Group 1 entities. Group 1 entities are entities that satisfy at least two of the following:

- the consolidated revenue for the financial year of the entity and the entities it controls (if any) is $500 million or more;

- the value of the consolidated gross assets at the end of the financial year of the entity and the entities it controls (if any) is $1 billion or more;

- the entity and the entities it controls (if any) have 500 or more employees at the end of the financial year.

What sort of climate reporting will I need to provide?

The provisions require large entities to prepare a sustainability report in line with the standards set by the Australian Accounting Standards Board (AASB), using the International Sustainability Standards Board (ISSB)’s framework as a baseline. The focus of these disclosures is on financial materiality, emphasising the financial impacts of climate-related risks and opportunities on an entity’s performance and prospects.

Three years for entities to make substantive provisions

The Act contains transitional arrangements and will not come fully into force until 1 July 2027. The first three years of these amendments to the Corporations Act, the directors are required to declare that the entity has taken reasonable steps to ensure the substantive provisions of the sustainability report are in accordance with the Corporations Act. After the three years has passed, the directors will need to declare whether the substantive provisions of the sustainability report are in accordance with the Corporations Act.

Group 2 and 3 definitions

The commencement of reporting obligations for Group 2 and Group 3 entities start, respectively, on 1 July 2026 and 1 July 2027. For their definitions see the table below:

Businesses must prepare for climate compliance

The adoption of the Act marks a significant shift and requires businesses to actively prepare for compliance with the new climate reporting standards starting from 2025.

Please contact Macpherson Kelley’s ESG Team if you have questions or require expert assistance.