Increase of Probate Lodging Fees – What’s All the Fuss About?

Background

In June 2024 the Victorian Government released a Regulatory Impact Statement (“RIS”) which details a review of the proposed options for dramatically increasing the lodging fees that are payable to the Supreme Court, Probate Office on the filing of a Grant of Representation (which is, typically, a Grant of Probate or Letters of Administration).

These fees are based on the gross value of the estate as contained in the Inventory of Assets and Liabilities that forms part of any application for a Grant of Representation.

Additionally, there’s a proposal to raise the cost of advertising a Grant of Representation (the mandatory advertisement that states the intention of the Legal Personal Representative to apply for the Grant). These modest increases aren’t the main focus here, but the proposed spikes in lodging fees have certainly caught the media’s eye due to their sheer magnitude.

Current lodging fees

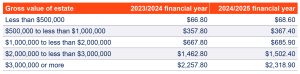

Currently, the lodging fees increase each financial year. They typically increase on average $2 to $60 or 3%.

To give some perspective, here’s a snapshot of the last two financial year increases:

What’s the purpose of the review?

The RIS released by the Department of Justice and Community Safety (“DJCS”) states that several factors have been used to guide the proposed increases which would be embodied in the Supreme Court (Fees) Amendments Regulations 2024 namely: –

- Fiscal Sustainability: ensuring fees support the financial stability of the Supreme Court;

- Access to Justice: maintaining affordable fees for lower-value estates to enhance access to the services of Probate Office;

- Reflective of Costs: ensuring fees accurately reflect the costs of service delivery; and

- Simplicity: fees being simple for users to understand and for the Court to administer.

The options for fee increases on the table

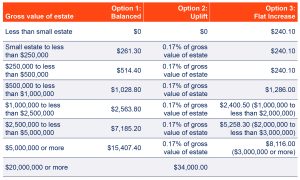

The DJCS has identified three possible options to increase lodging fees:-

Option 1: Balanced

- Lodging fees:

- Introducing a $0 fee for small estates;

- Increase lodging fees proportionate to estate value for anything other than a small estate;

- Implement different tiers for advertising fees; and

- Minor increase in small estate preparation fees to reflect the Probate Office’s full costs incurred.

Option 2: Uplift

- Lodging fees:

- Introducing a $0 fee for small estates;

- Lodging fees for anything other than a small estate to be 0.17% of estate value up to $20 million. Values over $20 million capped at $34,000;

- Increasing advertising fees;

- Increasing small estate preparation fees with the expected remuneration chargeable for a solicitor in obtaining a grant of representation; and

- Increase in all other fees by 10%.

Option 3: Flat Increase

- Maintain the current fee structure ranges and simply increase all fees by 250%.

Proposed probate lodging fees

In application, if the gross value of an estate was $5,000,000, the fees increases can be compared as follows:-

This correlates to a percentage increase based on the current system as follows:-

Weighing in on the options

The proposed options were evaluated based on four criteria – fiscal sustainability, access to justice, reflective of costs and simplicity.

Option 1 is the Victorian Government’s current preferred option. It argues that is strikes a balance between financial sustainability and access to justice.

The outcry to date has been based on the vast percentage increases which are typically 3% pa. The review is suggesting altering the lodging fees by an increase of 564%, 266% or 250% based on the above example of an estate worth $5,000,000. As such, it is argued that such increases are really a form of death tax by stealth.

What are the next steps?

If the probate lodging fees review moves into legislation, it is proposed that the changes commence on 29 December 2024. The DJCS have stated that they will evaluate the effectiveness of the new fee structure in 2027 as part of the sun-setting process for the Supreme Court (Fees) Regulations 2018.

How Macpherson Kelley can help

If you would like more detailed information around this area of the law or unsure if how these changes will affect your estate planning, please feel free to contact the Private Clients team at Macpherson Kelley.

The information contained in this article is general in nature and cannot be relied on as legal advice nor does it create an engagement. Please contact one of our lawyers listed above for advice about your specific situation.

stay up to date with our news & insights

Increase of Probate Lodging Fees – What’s All the Fuss About?

Background

In June 2024 the Victorian Government released a Regulatory Impact Statement (“RIS”) which details a review of the proposed options for dramatically increasing the lodging fees that are payable to the Supreme Court, Probate Office on the filing of a Grant of Representation (which is, typically, a Grant of Probate or Letters of Administration).

These fees are based on the gross value of the estate as contained in the Inventory of Assets and Liabilities that forms part of any application for a Grant of Representation.

Additionally, there’s a proposal to raise the cost of advertising a Grant of Representation (the mandatory advertisement that states the intention of the Legal Personal Representative to apply for the Grant). These modest increases aren’t the main focus here, but the proposed spikes in lodging fees have certainly caught the media’s eye due to their sheer magnitude.

Current lodging fees

Currently, the lodging fees increase each financial year. They typically increase on average $2 to $60 or 3%.

To give some perspective, here’s a snapshot of the last two financial year increases:

What’s the purpose of the review?

The RIS released by the Department of Justice and Community Safety (“DJCS”) states that several factors have been used to guide the proposed increases which would be embodied in the Supreme Court (Fees) Amendments Regulations 2024 namely: –

- Fiscal Sustainability: ensuring fees support the financial stability of the Supreme Court;

- Access to Justice: maintaining affordable fees for lower-value estates to enhance access to the services of Probate Office;

- Reflective of Costs: ensuring fees accurately reflect the costs of service delivery; and

- Simplicity: fees being simple for users to understand and for the Court to administer.

The options for fee increases on the table

The DJCS has identified three possible options to increase lodging fees:-

Option 1: Balanced

- Lodging fees:

- Introducing a $0 fee for small estates;

- Increase lodging fees proportionate to estate value for anything other than a small estate;

- Implement different tiers for advertising fees; and

- Minor increase in small estate preparation fees to reflect the Probate Office’s full costs incurred.

Option 2: Uplift

- Lodging fees:

- Introducing a $0 fee for small estates;

- Lodging fees for anything other than a small estate to be 0.17% of estate value up to $20 million. Values over $20 million capped at $34,000;

- Increasing advertising fees;

- Increasing small estate preparation fees with the expected remuneration chargeable for a solicitor in obtaining a grant of representation; and

- Increase in all other fees by 10%.

Option 3: Flat Increase

- Maintain the current fee structure ranges and simply increase all fees by 250%.

Proposed probate lodging fees

In application, if the gross value of an estate was $5,000,000, the fees increases can be compared as follows:-

This correlates to a percentage increase based on the current system as follows:-

Weighing in on the options

The proposed options were evaluated based on four criteria – fiscal sustainability, access to justice, reflective of costs and simplicity.

Option 1 is the Victorian Government’s current preferred option. It argues that is strikes a balance between financial sustainability and access to justice.

The outcry to date has been based on the vast percentage increases which are typically 3% pa. The review is suggesting altering the lodging fees by an increase of 564%, 266% or 250% based on the above example of an estate worth $5,000,000. As such, it is argued that such increases are really a form of death tax by stealth.

What are the next steps?

If the probate lodging fees review moves into legislation, it is proposed that the changes commence on 29 December 2024. The DJCS have stated that they will evaluate the effectiveness of the new fee structure in 2027 as part of the sun-setting process for the Supreme Court (Fees) Regulations 2018.

How Macpherson Kelley can help

If you would like more detailed information around this area of the law or unsure if how these changes will affect your estate planning, please feel free to contact the Private Clients team at Macpherson Kelley.