Increased penalties for breach of Competition and Consumer Act

This holiday season has seen major changes to the trade and compliance space that require immediate action from businesses. So, the team at Macpherson Kelley is making sure you’ve made a list and you’re checking it twice!

We’ll be releasing a series of accessible guides and articles on what your business needs to do to stay on Santa’s nice list this year – with the help and guidance of our trade and compliance team.

Further to our recent article on competition and consumer law penalties, huge increases to maximum penalties for breaches of the Competition and Consumer Act 2010 (Cth) (CCA) including the Australian Consumer Law (ACL) are now in force.

What is the penalty increase?

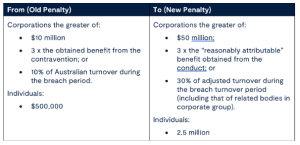

The penalty increase is significant and from a business perspective, cannot be ignored. Some of the penalties have increased five-fold, as of 10 November 2022.

To better understand the changes, please see them detailed in the table below.

The potential for a 10 year jail term for cartel conduct also remains.

What conduct is covered?

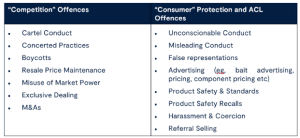

The new maximum penalties have widespread (but not blanket) application to conduct. We’ve included a list of the main types of conduct in the table below.

Why the change to penalties?

Deterrence! The increase to the maximum penalties is to deter businesses from not complying with their obligations, to provide hip-pocket financial incentives to businesses to comply, and to ensure that businesses do not mislead or act unconscionably towards their consumers and trading partners.

What do businesses need to do?

Make CCA and ACL compliance a priority for your business!

- Protect your business by implementing the required policies and procedures.

- Protect your staff by training them in the law and the “do’s and don’ts” relevant to their role.

Need more information or assistance?

For further information about the changes to the CCA maximum penalties, your business obligations and a review of your compliance measures, please contact one of our experts.

The information contained in this article is general in nature and cannot be relied on as legal advice nor does it create an engagement. Please contact one of our lawyers listed above for advice about your specific situation.

more

insights

Voluntary dealings with regulators: Practical insights, tips & traps for agribusinesses

A change of director can trigger landholder duty says Victorian Supreme Court

Clarifying the boundaries of trade mark defences: The Fanatics case as a cautionary tale

stay up to date with our news & insights

Increased penalties for breach of Competition and Consumer Act

This holiday season has seen major changes to the trade and compliance space that require immediate action from businesses. So, the team at Macpherson Kelley is making sure you’ve made a list and you’re checking it twice!

We’ll be releasing a series of accessible guides and articles on what your business needs to do to stay on Santa’s nice list this year – with the help and guidance of our trade and compliance team.

Further to our recent article on competition and consumer law penalties, huge increases to maximum penalties for breaches of the Competition and Consumer Act 2010 (Cth) (CCA) including the Australian Consumer Law (ACL) are now in force.

What is the penalty increase?

The penalty increase is significant and from a business perspective, cannot be ignored. Some of the penalties have increased five-fold, as of 10 November 2022.

To better understand the changes, please see them detailed in the table below.

The potential for a 10 year jail term for cartel conduct also remains.

What conduct is covered?

The new maximum penalties have widespread (but not blanket) application to conduct. We’ve included a list of the main types of conduct in the table below.

Why the change to penalties?

Deterrence! The increase to the maximum penalties is to deter businesses from not complying with their obligations, to provide hip-pocket financial incentives to businesses to comply, and to ensure that businesses do not mislead or act unconscionably towards their consumers and trading partners.

What do businesses need to do?

Make CCA and ACL compliance a priority for your business!

- Protect your business by implementing the required policies and procedures.

- Protect your staff by training them in the law and the “do’s and don’ts” relevant to their role.

Need more information or assistance?

For further information about the changes to the CCA maximum penalties, your business obligations and a review of your compliance measures, please contact one of our experts.