Myth-busting payroll tax

Most businesses are aware that ‘wages’ for payroll tax extend beyond the ordinary meaning – for example to directors fees and some fringe benefits.

The most common surprise for businesses is that your ‘independent contractors’ are treated as employees for the purposes of payroll tax. The next surprise? Payments made to your independent contractors are, at first instance, caught as wages (unless a relevant contractor exemption applies). But the biggest surprise of all? That you are an employment agency.

There remains much confusion regarding the application of a number of rules under the ‘harmonised’ payroll tax regime – none more than the relevant contract and employment agency contract provisions and the crucial differences between them.

From financial penalties to red flags in a prospective sale – failing to understand the operation of these rules and their potential application can lead to serious consequences for businesses.

Amounts paid under ‘relevant contracts’

While not wages in the ordinary sense, payments made by a business to contracted third parties may be taxable ‘wages’ for payroll tax purposes, if made under a ‘relevant contract’.

A relevant contract is any contract under which a person, while carrying on a business, supplies, or is supplied with services.

Most third-party contractor agreements will be caught under the wide ambit of a “relevant contract”.

These rules are, however, aimed at capturing payments made to contractors under an arrangement that is, for all intents and purposes, one of employer-employee.

As such, several exemptions can apply to exclude payments made under a principal-contractor arrangement from payroll tax ‘wages’ which we have previously examined in greater detail.

Employment agency contracts

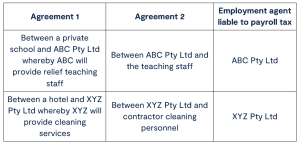

Distinct from the relevant contract rules, the employment agency contract provisions operate where a business (the employment agent) procures the services of a person (the worker) for a client of the employment agent – effectively as an intermediary.

Where an employment agency contract exists, for payroll tax purposes:

- the identified employment agent is deemed to be the employer of the worker who is ultimately providing the services to the client;

- amounts paid to the worker are taken to be wages paid/payable by the employment agent – unless the wages are exempt wages (see below).

- One common misconception is that these provisions only apply to a traditional labour hire scenario. In reality however, the employment agency provisions have a far broader reach that can apply to most scenarios where an intermediary is involved.

Under these arrangements, there is:

- an agreement between the purported employment agent and the ultimate client;

- no agreement between the worker and the client.

Some common examples of where the provisions may operate:

‘In and for’ the client’s business

The Integrated Trolley Management decisions dealt with payments from Integrated Trolley Management Pty Ltd (ITM) to contractors to perform trolley collection and cleaning services under contracts ITM has with Woolworths, ALDI and IGA.

The cases dealt with the colloquially referred to “in and for test” which limits the circumstances in which subcontracted workers are caught by the employment agency provisions.

At first instance, the New South Wales Supreme Court found in favour of the taxpayer – the payments made from ITM to the subcontractors were not captured by the rules.

The ‘in’ assesses whether the workers are engaged in tasks integral to the operations of the ultimate client’s business – in ITM, that is the relevant grocery store. In our above examples, the private school and the hotel.

The ‘for’ evaluates whether the workers are performing their duties primarily for the client’s benefit.

If the work provided by the workers serves the client’s business interests (in the same way or much the same way as it would through an employee) it reinforces the argument that the arrangement could be captured.

‘In and for’ test satisfied says Chief Commissioner

Allowing the Chief Commissioner’s appeal, the Court found the workers were closely integrated into the operations of ITM’s clients, fulfilling essential roles that were fundamental to the business, such that the “in and for” test had been satisfied.

A few important factors in considering the test:

to be captured – subcontractors who carry out the work for the client should do so in much the same way as would an employee of the client (Hypothetical Employee Comparison), meaning that the business would involve work having a degree or regulatory and continuity.

- A contractual right of control by a client over the workers may be a strong indicator that the service providers are working in and for the conduct of the client’s business in the context of the Hypothetical Employee Comparison.

- The focus is on the way the services are provided for the client and not upon extraneous matters (i.e. uniforms, using staff facilities, interactions with client staff and customers).[1]

- The weight given to the relevant indicia in the analysis of whether services are procured “in and for” the conduct of the business of a client will vary from case to case.

- The “in and for” test can indeed be complex, as it involves nuanced interpretations of various legal principles. Its application hinges on specific factual contexts, and we expect to see case law continue to evolve in this area.

Relevant contract vs. employment agency contract

There is a crucial difference between the relevant contract and employment agency rules – the exemptions that can be applied to exclude relevant contract payments cannot be applied to circumstances where an employment agency contract exists.

Where payments have been made by an employment agent – they can only be excluded where they are exempt wages.

Wages are exempt wages for the employment agency provisions only where:

- the worker had instead performed the services as an employee of the client;

- the wages would have been exempt under another provision of the Act; and

- the client has given a declaration to the relevant revenue authority confirming that exempt status.

Wages are exempt where they are paid by a range of organisations including religious institutions, public benevolent institutions, public hospitals and not-for-profit hospitals and private schools.

Nowhere to hide

We continue to see increased audit activity in this space. Do your business a favour by undertaking an internal review of payroll tax obligations to ensure that the rules have not been erroneously overlooked or incorrectly applied. It is essential to stay informed and seek professional advice if needed, remembering that ignorance of the law is not a defence.

Where a review uncovers historical shortfalls, proactively addressing issues (this may involve making voluntary disclosures to the Commissioner) will result in reduced penalties associated with the underpayments/underreporting.

Payroll tax especially remains a headline issue in the due diligence processes of a business sale, with unresolved issues potentially leading to more extensive investigations and concerns about financial health.

Contact Macpherson Kelley’s Tax team for advice

If you would like further advice on payroll tax and the relevant definitions that often see businesses in hot water. Contact our experienced team for a confidential chat.

[1] ITM Appeal [99]-[101].

The information contained in this article is general in nature and cannot be relied on as legal advice nor does it create an engagement. Please contact one of our lawyers listed above for advice about your specific situation.

more

insights

Voluntary dealings with regulators: Practical insights, tips & traps for agribusinesses

A change of director can trigger landholder duty says Victorian Supreme Court

Clarifying the boundaries of trade mark defences: The Fanatics case as a cautionary tale

stay up to date with our news & insights

Myth-busting payroll tax

Most businesses are aware that ‘wages’ for payroll tax extend beyond the ordinary meaning – for example to directors fees and some fringe benefits.

The most common surprise for businesses is that your ‘independent contractors’ are treated as employees for the purposes of payroll tax. The next surprise? Payments made to your independent contractors are, at first instance, caught as wages (unless a relevant contractor exemption applies). But the biggest surprise of all? That you are an employment agency.

There remains much confusion regarding the application of a number of rules under the ‘harmonised’ payroll tax regime – none more than the relevant contract and employment agency contract provisions and the crucial differences between them.

From financial penalties to red flags in a prospective sale – failing to understand the operation of these rules and their potential application can lead to serious consequences for businesses.

Amounts paid under ‘relevant contracts’

While not wages in the ordinary sense, payments made by a business to contracted third parties may be taxable ‘wages’ for payroll tax purposes, if made under a ‘relevant contract’.

A relevant contract is any contract under which a person, while carrying on a business, supplies, or is supplied with services.

Most third-party contractor agreements will be caught under the wide ambit of a “relevant contract”.

These rules are, however, aimed at capturing payments made to contractors under an arrangement that is, for all intents and purposes, one of employer-employee.

As such, several exemptions can apply to exclude payments made under a principal-contractor arrangement from payroll tax ‘wages’ which we have previously examined in greater detail.

Employment agency contracts

Distinct from the relevant contract rules, the employment agency contract provisions operate where a business (the employment agent) procures the services of a person (the worker) for a client of the employment agent – effectively as an intermediary.

Where an employment agency contract exists, for payroll tax purposes:

- the identified employment agent is deemed to be the employer of the worker who is ultimately providing the services to the client;

- amounts paid to the worker are taken to be wages paid/payable by the employment agent – unless the wages are exempt wages (see below).

- One common misconception is that these provisions only apply to a traditional labour hire scenario. In reality however, the employment agency provisions have a far broader reach that can apply to most scenarios where an intermediary is involved.

Under these arrangements, there is:

- an agreement between the purported employment agent and the ultimate client;

- no agreement between the worker and the client.

Some common examples of where the provisions may operate:

‘In and for’ the client’s business

The Integrated Trolley Management decisions dealt with payments from Integrated Trolley Management Pty Ltd (ITM) to contractors to perform trolley collection and cleaning services under contracts ITM has with Woolworths, ALDI and IGA.

The cases dealt with the colloquially referred to “in and for test” which limits the circumstances in which subcontracted workers are caught by the employment agency provisions.

At first instance, the New South Wales Supreme Court found in favour of the taxpayer – the payments made from ITM to the subcontractors were not captured by the rules.

The ‘in’ assesses whether the workers are engaged in tasks integral to the operations of the ultimate client’s business – in ITM, that is the relevant grocery store. In our above examples, the private school and the hotel.

The ‘for’ evaluates whether the workers are performing their duties primarily for the client’s benefit.

If the work provided by the workers serves the client’s business interests (in the same way or much the same way as it would through an employee) it reinforces the argument that the arrangement could be captured.

‘In and for’ test satisfied says Chief Commissioner

Allowing the Chief Commissioner’s appeal, the Court found the workers were closely integrated into the operations of ITM’s clients, fulfilling essential roles that were fundamental to the business, such that the “in and for” test had been satisfied.

A few important factors in considering the test:

to be captured – subcontractors who carry out the work for the client should do so in much the same way as would an employee of the client (Hypothetical Employee Comparison), meaning that the business would involve work having a degree or regulatory and continuity.

- A contractual right of control by a client over the workers may be a strong indicator that the service providers are working in and for the conduct of the client’s business in the context of the Hypothetical Employee Comparison.

- The focus is on the way the services are provided for the client and not upon extraneous matters (i.e. uniforms, using staff facilities, interactions with client staff and customers).[1]

- The weight given to the relevant indicia in the analysis of whether services are procured “in and for” the conduct of the business of a client will vary from case to case.

- The “in and for” test can indeed be complex, as it involves nuanced interpretations of various legal principles. Its application hinges on specific factual contexts, and we expect to see case law continue to evolve in this area.

Relevant contract vs. employment agency contract

There is a crucial difference between the relevant contract and employment agency rules – the exemptions that can be applied to exclude relevant contract payments cannot be applied to circumstances where an employment agency contract exists.

Where payments have been made by an employment agent – they can only be excluded where they are exempt wages.

Wages are exempt wages for the employment agency provisions only where:

- the worker had instead performed the services as an employee of the client;

- the wages would have been exempt under another provision of the Act; and

- the client has given a declaration to the relevant revenue authority confirming that exempt status.

Wages are exempt where they are paid by a range of organisations including religious institutions, public benevolent institutions, public hospitals and not-for-profit hospitals and private schools.

Nowhere to hide

We continue to see increased audit activity in this space. Do your business a favour by undertaking an internal review of payroll tax obligations to ensure that the rules have not been erroneously overlooked or incorrectly applied. It is essential to stay informed and seek professional advice if needed, remembering that ignorance of the law is not a defence.

Where a review uncovers historical shortfalls, proactively addressing issues (this may involve making voluntary disclosures to the Commissioner) will result in reduced penalties associated with the underpayments/underreporting.

Payroll tax especially remains a headline issue in the due diligence processes of a business sale, with unresolved issues potentially leading to more extensive investigations and concerns about financial health.

Contact Macpherson Kelley’s Tax team for advice

If you would like further advice on payroll tax and the relevant definitions that often see businesses in hot water. Contact our experienced team for a confidential chat.

[1] ITM Appeal [99]-[101].