Proposed PPS Framework Reform

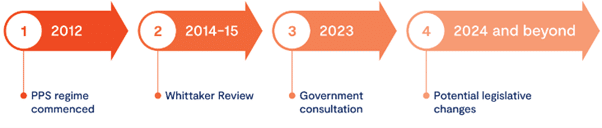

The Personal Property Securities (PPS) regime commenced in Australia on 30 January 2012. Over the last 12 years, businesses have had to implement and get used to an entirely new system for registering “security interests” claimed in and over “personal property”.

Review of PPS regime

In 2014, a statutory review of the operation and effectiveness of the PPS regime was undertaken (the Whittaker Review). The Whittaker Review’s final report (published in 2015) ultimately made 394 recommendations for changes to the PPS regime, with a view to making it more simplified, more clear and more accessible to users.

Between September to November 2023, the Australian Government consulted publicly on its proposed response to the Whittaker Review – outlining the recommendations it proposes to adopt and circulating draft amendment legislation.

Whilst the proposed changes are still exactly just that – proposals not yet in law – it pays for businesses to start thinking now about the potential reforms, the impacts they will have on business, and the changes that will be required to the business’ trading documents, internal credit processes and more.

Proposed changes

Of the Whittaker Review’s 394 recommendations, the Government appears set to adopt 345 of the changes (either in whole or in part). The sheer volume of changes adopted for acceptance indicates a major overhaul of the PPS regime.

Many of the important proposed changes with real life impact for businesses can be grouped as follows:

- Amendments to the scope and operation of the Personal Property Securities Act (PPS Act);

- Amendments to improve the use and functionality of the online PPS Register; and

- Amendments to provide clarity and consistency in concepts.

Some of the key changes likely for businesses are:

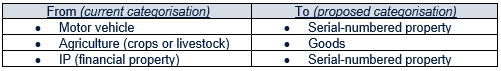

- Reduction in the number and type of “collateral classes” available to choose from: down from 9 classes to only 6 classes, eg:

- Changes to some commonly-used (and some simply fundamental) concepts and definitions: eg, “personal property”, “security interest”, “inventory”, “motor vehicle”, “PPS Lease”, “accession”, “processed goods” and “commingled goods”.

- Changes to timeframes for required actions: eg, changes to “temporary perfection”, registration upload and registration removal.

- Changes to security interest duration: eg, 25 years (for “All PAPs”), and 7 years (for all other types of registrations).

- Changing the current “Amendment Demand” process so that it is simplified (including by way of a reverse onus of proof).

- The PPS Registrar will be given wider and broader regulatory powers, including the ability to issue injunctions and monetary infringements.

However, some of the changes that businesses are likely welcome include:

- Simplifying some of the strict requirements for properly identifying a “secured party” and “grantor”.

- Ticking (or not ticking) the “PMSI” checkbox in error, no longer potentially rendering a registration ineffective / invalid.

- The ability to enable a registration to be made against a number of different collateral classes at the same time.

- A new look, feel, layout and more simple navigation for the online PPS Register.

What’s the impact?

Once (or if) the amendment legislation is passed, it is thought that businesses will be afforded a 2-year transition period.

To comply with the changes, businesses will need to:

- Amend T+Cs, finance documents and other contracts and trading documents, etc, to reflect the new terminology, definitions, timeframes, rights and obligations.

- Update internal policy documents, checklists, training materials and other resources used by staff (particularly the business’ accounts and credit control teams).

Macpherson Kelley can assist

Compliance with the changes (once passed) will be absolutely essential for businesses to meet, comply with and take advantage of the protections afforded by the PPS regime.

Whilst the PPS regime remains a voluntary regime, it will also remain the case that failure to utilise it could have critical impact on business, including loss of assets, inability to recover assets or monies owed, and relegation to the “end of the queue” as an unsecured creditor in the event of the grantor’s insolvency.

For further detail on the proposed changes, or for advice and assistance on your business’ current and future PPS compliance measures, please contact our expert Trade team at Macpherson Kelley.

The information contained in this article is general in nature and cannot be relied on as legal advice nor does it create an engagement. Please contact one of our lawyers listed above for advice about your specific situation.

more

insights

ASIC redacts officeholder data: What your business needs to know

Implied contract terms: Court of Appeal confirms no implied right for hospital to terminate long term emergency services agreement

Bunnings faces off against the Privacy Commissioner over facial recognition technology

stay up to date with our news & insights

Proposed PPS Framework Reform

The Personal Property Securities (PPS) regime commenced in Australia on 30 January 2012. Over the last 12 years, businesses have had to implement and get used to an entirely new system for registering “security interests” claimed in and over “personal property”.

Review of PPS regime

In 2014, a statutory review of the operation and effectiveness of the PPS regime was undertaken (the Whittaker Review). The Whittaker Review’s final report (published in 2015) ultimately made 394 recommendations for changes to the PPS regime, with a view to making it more simplified, more clear and more accessible to users.

Between September to November 2023, the Australian Government consulted publicly on its proposed response to the Whittaker Review – outlining the recommendations it proposes to adopt and circulating draft amendment legislation.

Whilst the proposed changes are still exactly just that – proposals not yet in law – it pays for businesses to start thinking now about the potential reforms, the impacts they will have on business, and the changes that will be required to the business’ trading documents, internal credit processes and more.

Proposed changes

Of the Whittaker Review’s 394 recommendations, the Government appears set to adopt 345 of the changes (either in whole or in part). The sheer volume of changes adopted for acceptance indicates a major overhaul of the PPS regime.

Many of the important proposed changes with real life impact for businesses can be grouped as follows:

- Amendments to the scope and operation of the Personal Property Securities Act (PPS Act);

- Amendments to improve the use and functionality of the online PPS Register; and

- Amendments to provide clarity and consistency in concepts.

Some of the key changes likely for businesses are:

- Reduction in the number and type of “collateral classes” available to choose from: down from 9 classes to only 6 classes, eg:

- Changes to some commonly-used (and some simply fundamental) concepts and definitions: eg, “personal property”, “security interest”, “inventory”, “motor vehicle”, “PPS Lease”, “accession”, “processed goods” and “commingled goods”.

- Changes to timeframes for required actions: eg, changes to “temporary perfection”, registration upload and registration removal.

- Changes to security interest duration: eg, 25 years (for “All PAPs”), and 7 years (for all other types of registrations).

- Changing the current “Amendment Demand” process so that it is simplified (including by way of a reverse onus of proof).

- The PPS Registrar will be given wider and broader regulatory powers, including the ability to issue injunctions and monetary infringements.

However, some of the changes that businesses are likely welcome include:

- Simplifying some of the strict requirements for properly identifying a “secured party” and “grantor”.

- Ticking (or not ticking) the “PMSI” checkbox in error, no longer potentially rendering a registration ineffective / invalid.

- The ability to enable a registration to be made against a number of different collateral classes at the same time.

- A new look, feel, layout and more simple navigation for the online PPS Register.

What’s the impact?

Once (or if) the amendment legislation is passed, it is thought that businesses will be afforded a 2-year transition period.

To comply with the changes, businesses will need to:

- Amend T+Cs, finance documents and other contracts and trading documents, etc, to reflect the new terminology, definitions, timeframes, rights and obligations.

- Update internal policy documents, checklists, training materials and other resources used by staff (particularly the business’ accounts and credit control teams).

Macpherson Kelley can assist

Compliance with the changes (once passed) will be absolutely essential for businesses to meet, comply with and take advantage of the protections afforded by the PPS regime.

Whilst the PPS regime remains a voluntary regime, it will also remain the case that failure to utilise it could have critical impact on business, including loss of assets, inability to recover assets or monies owed, and relegation to the “end of the queue” as an unsecured creditor in the event of the grantor’s insolvency.

For further detail on the proposed changes, or for advice and assistance on your business’ current and future PPS compliance measures, please contact our expert Trade team at Macpherson Kelley.