SMEs & mandatory sustainability reporting 101: The basics

Australia is setting a strong example in climate transparency as a global early adopter of the recent mandatory sustainability and emissions reporting rules. These scale across business sizes, gradually drawing in a broader range of industries and businesses. While large entities are the initial focus, small to medium enterprises (SMEs) embedded in supply chains will be asked to provide climate-related data. This shift could bring operational and financial challenges, making preparation of data collection and strategic planning essential – but as with any change, there are also opportunities.

In the first of two articles, we will look at the rules and how SMEs are affected. The second article will consider lessons learned and opportunities form SMEs arising out of this legislation.

Key takeaways for SMEs addressing mandatory sustainability reporting

- Mandatory sustainability reporting has already started in Australia.

- From 1 July 2025, large businesses and financial institutions falling within Group 1 of Chapter 2M of the Corporations Act 2001 (the Act) must annually report their climate-related financial risks, opportunities, strategies, and transition plans.

- SMEs may now or soon face indirect pressure to provide sustainability and emissions data to larger partners.

- Starting 1 July 2026, more businesses and industries will be captured, making compliance readiness even more urgent.

- SMEs must now assess whether they are prepared.

Reporting thresholds for climate related financial disclosure

In the words of Peter Drucker, a pioneer in modern management theory, “What gets measured gets managed”. This mandatory reporting regime provides an international baseline against which companies’ performance in sustainability can be measured and therefore managed. Many countries and more importantly, financial institutions, subscribe to this theory.

To achieve consistency of measurement, the Commonwealth Government last year enacted the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill. This amends the Corporations Act 2001 (Cth) (the Act) and formally mandates sustainability reporting for entities governed by Chapter 2M of the Act.

This legislative change marks a generational step in embedding environmental, social, and governance (ESG) principles into corporate reporting, with climate-related disclosures forming a key component of the broader ESG framework.

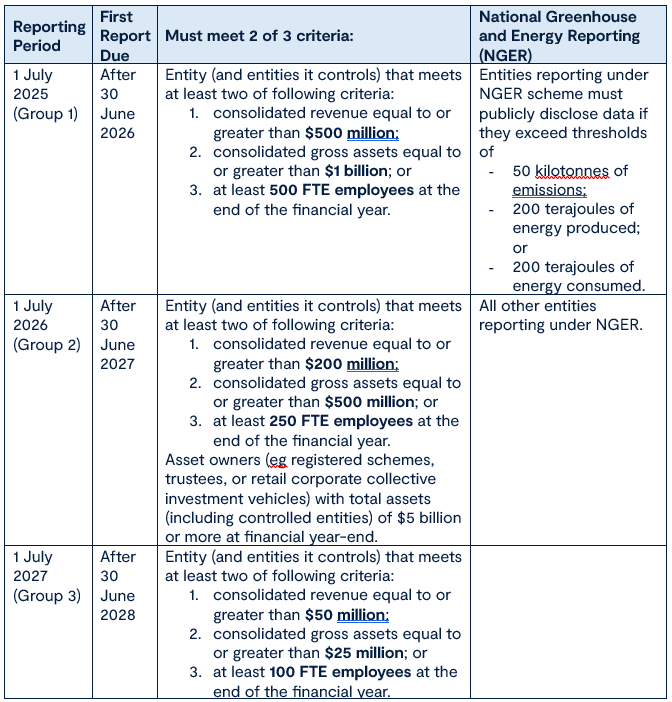

An entity must prepare an annual sustainability report if the entity has to lodge financial reports under Chapter 2M of the Act and the entity either:

- meets prescribed size thresholds (see below); or

- is a ‘registered corporation’ under NGER Act.

Entities that do not meet these thresholds, like small proprietary companies, are not required to report under the Act – for now at least. However, even these entities may well face indirect pressure to disclose sustainability data because many of them will be part of the supply chains of larger reporting entities.

Impact on SMEs

Group 1 entities include major players in mining and resources, the big four banks, and large retail conglomerates. SMEs operating within the supply chains of Group 1 entities will probably already be being asked to provide information. Larger businesses are increasingly requesting climate-related data and disclosures from their suppliers and contractors to meet their own reporting obligations.

From July next year, Group 2 entities must also report and may require detailed sustainability and emissions data from SME partners within their supply chains.

What will mandatory sustainability reporting look like?

Reporting includes metrics like energy consumption, waste management practices and carbon footprint, and capital or expenditure deployed toward climate-related opportunities. This is likely to mean SMEs having to spend more time and effort to respond to all of the Group 1 and Group 2 requests.

In an ideal world, SMEs would have their systems and processes set up and operating smoothly by July 2026. This world is far from ideal as we know but you have to start somewhere.

Recommendations for SMEs

SMEs should start to record, collect, manage, and disclose sustainability-related information. That might require new IT systems, new resources (human and technical) and upskilling of officers, staff and stakeholders, all of which comes at a cost.

In a world where time-poor SMEs are under an ever-increasing burden of new regulation and costs pressures, many have a limited capacity to manage the effects of this compliance. At least ASIC has indicated that enforcing compliance will be phased in.

Given the increasing compliance burden for SMEs and the tightening economy, few SMEs are likely to find this new regime easy or attractive to implement. If you need assistance, contact our dedicated team of lawyers working within the ESG space.

The information contained in this article is general in nature and cannot be relied on as legal advice nor does it create an engagement. Please contact one of our lawyers listed above for advice about your specific situation.

more

insights

ASIC redacts officeholder data: What your business needs to know

Implied contract terms: Court of Appeal confirms no implied right for hospital to terminate long term emergency services agreement

Bunnings faces off against the Privacy Commissioner over facial recognition technology

stay up to date with our news & insights

SMEs & mandatory sustainability reporting 101: The basics

Australia is setting a strong example in climate transparency as a global early adopter of the recent mandatory sustainability and emissions reporting rules. These scale across business sizes, gradually drawing in a broader range of industries and businesses. While large entities are the initial focus, small to medium enterprises (SMEs) embedded in supply chains will be asked to provide climate-related data. This shift could bring operational and financial challenges, making preparation of data collection and strategic planning essential – but as with any change, there are also opportunities.

In the first of two articles, we will look at the rules and how SMEs are affected. The second article will consider lessons learned and opportunities form SMEs arising out of this legislation.

Key takeaways for SMEs addressing mandatory sustainability reporting

- Mandatory sustainability reporting has already started in Australia.

- From 1 July 2025, large businesses and financial institutions falling within Group 1 of Chapter 2M of the Corporations Act 2001 (the Act) must annually report their climate-related financial risks, opportunities, strategies, and transition plans.

- SMEs may now or soon face indirect pressure to provide sustainability and emissions data to larger partners.

- Starting 1 July 2026, more businesses and industries will be captured, making compliance readiness even more urgent.

- SMEs must now assess whether they are prepared.

Reporting thresholds for climate related financial disclosure

In the words of Peter Drucker, a pioneer in modern management theory, “What gets measured gets managed”. This mandatory reporting regime provides an international baseline against which companies’ performance in sustainability can be measured and therefore managed. Many countries and more importantly, financial institutions, subscribe to this theory.

To achieve consistency of measurement, the Commonwealth Government last year enacted the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill. This amends the Corporations Act 2001 (Cth) (the Act) and formally mandates sustainability reporting for entities governed by Chapter 2M of the Act.

This legislative change marks a generational step in embedding environmental, social, and governance (ESG) principles into corporate reporting, with climate-related disclosures forming a key component of the broader ESG framework.

An entity must prepare an annual sustainability report if the entity has to lodge financial reports under Chapter 2M of the Act and the entity either:

- meets prescribed size thresholds (see below); or

- is a ‘registered corporation’ under NGER Act.

Entities that do not meet these thresholds, like small proprietary companies, are not required to report under the Act – for now at least. However, even these entities may well face indirect pressure to disclose sustainability data because many of them will be part of the supply chains of larger reporting entities.

Impact on SMEs

Group 1 entities include major players in mining and resources, the big four banks, and large retail conglomerates. SMEs operating within the supply chains of Group 1 entities will probably already be being asked to provide information. Larger businesses are increasingly requesting climate-related data and disclosures from their suppliers and contractors to meet their own reporting obligations.

From July next year, Group 2 entities must also report and may require detailed sustainability and emissions data from SME partners within their supply chains.

What will mandatory sustainability reporting look like?

Reporting includes metrics like energy consumption, waste management practices and carbon footprint, and capital or expenditure deployed toward climate-related opportunities. This is likely to mean SMEs having to spend more time and effort to respond to all of the Group 1 and Group 2 requests.

In an ideal world, SMEs would have their systems and processes set up and operating smoothly by July 2026. This world is far from ideal as we know but you have to start somewhere.

Recommendations for SMEs

SMEs should start to record, collect, manage, and disclose sustainability-related information. That might require new IT systems, new resources (human and technical) and upskilling of officers, staff and stakeholders, all of which comes at a cost.

In a world where time-poor SMEs are under an ever-increasing burden of new regulation and costs pressures, many have a limited capacity to manage the effects of this compliance. At least ASIC has indicated that enforcing compliance will be phased in.

Given the increasing compliance burden for SMEs and the tightening economy, few SMEs are likely to find this new regime easy or attractive to implement. If you need assistance, contact our dedicated team of lawyers working within the ESG space.