Strengthening of the UCT regime

As you may be aware, the regime prohibiting “Unfair Terms in Standard Form Consumer and Small Business Contracts” (UCT regime) has been significantly strengthened.

Active Enforcement

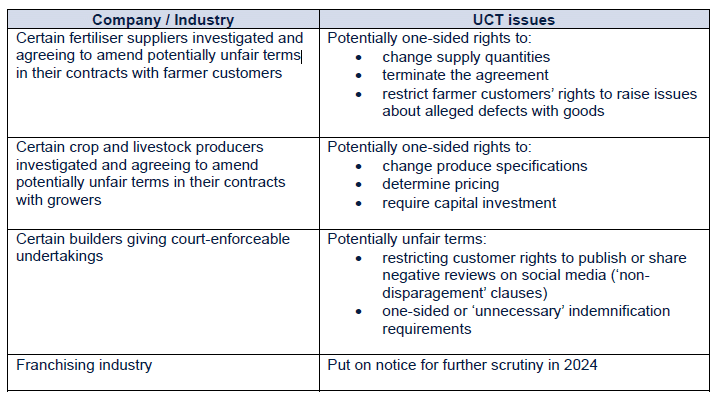

Businesses had a 1-year lead-in before the most recent suite of amendments came into full effect. However, even during that time, the Regulators continued to show an evident focus and priority on compliance, both with the UCT laws (as they then were), and for the future changes. For example:

What’s the impact?

Assume your contracts are caught. With the significantly expanded scope and operation, it is estimated that some 98% of small businesses now benefit from protections under the UCT regime.

The strengthened UCT regime also includes a range of more severe penalties and consequences for breaches and non-compliance, including:

- Financial penalties: the greater of $50M, 3 x the benefit received from the contravention, or 30% of adjusted turnover (in some respects, a 5-fold increase!);

- Orders preventing the same (or similar) terms from being used in future contracts (whether with the relevant party or with any other party); and

- Orders for redress and compensation.

Importantly, many of the expanded powers and remedies available to Courts also mean that the risk to your business is not over once the immediate penalty for the specific UCT in question has been paid or resolved. The risk:

- can still remain for 6 years (available to third parties if their contract with you contains the same or similar clauses as the ones found to be unfair);

- can endure across the sale of your business contract assets to bind a subsequent purchaser of your business; and

- can endure across your purchase of a business (if that business has previously been prosecuted).

MK can assist

Simply put – if you have not yet reviewed your “standard form” contracts for potential unfairness, you need to do so.

For further detail on the UCT regime, or for a review and advice on the content of your T+Cs and other standard form trading documents, please contact our expert Trade team at Macpherson Kelley.

The information contained in this article is general in nature and cannot be relied on as legal advice nor does it create an engagement. Please contact one of our lawyers listed above for advice about your specific situation.

more

insights

Voluntary dealings with regulators: Practical insights, tips & traps for agribusinesses

A change of director can trigger landholder duty says Victorian Supreme Court

Clarifying the boundaries of trade mark defences: The Fanatics case as a cautionary tale

stay up to date with our news & insights

Strengthening of the UCT regime

As you may be aware, the regime prohibiting “Unfair Terms in Standard Form Consumer and Small Business Contracts” (UCT regime) has been significantly strengthened.

Active Enforcement

Businesses had a 1-year lead-in before the most recent suite of amendments came into full effect. However, even during that time, the Regulators continued to show an evident focus and priority on compliance, both with the UCT laws (as they then were), and for the future changes. For example:

What’s the impact?

Assume your contracts are caught. With the significantly expanded scope and operation, it is estimated that some 98% of small businesses now benefit from protections under the UCT regime.

The strengthened UCT regime also includes a range of more severe penalties and consequences for breaches and non-compliance, including:

- Financial penalties: the greater of $50M, 3 x the benefit received from the contravention, or 30% of adjusted turnover (in some respects, a 5-fold increase!);

- Orders preventing the same (or similar) terms from being used in future contracts (whether with the relevant party or with any other party); and

- Orders for redress and compensation.

Importantly, many of the expanded powers and remedies available to Courts also mean that the risk to your business is not over once the immediate penalty for the specific UCT in question has been paid or resolved. The risk:

- can still remain for 6 years (available to third parties if their contract with you contains the same or similar clauses as the ones found to be unfair);

- can endure across the sale of your business contract assets to bind a subsequent purchaser of your business; and

- can endure across your purchase of a business (if that business has previously been prosecuted).

MK can assist

Simply put – if you have not yet reviewed your “standard form” contracts for potential unfairness, you need to do so.

For further detail on the UCT regime, or for a review and advice on the content of your T+Cs and other standard form trading documents, please contact our expert Trade team at Macpherson Kelley.