Temporary Changes to Insolvency Laws: Australian Government Addresses Financial Distress for Businesses from COVID-19

On 22 March 2020, the Australian Federal Government announced a raft of proposed temporary changes to insolvency laws in light of the financial distress and challenges COVID-19 has caused to Australian businesses.

The proposed changes are summarised below:

companies

Statutory demands

One of the most common ways for companies to be wound up stems from non-compliance with a statutory demand. Creditors are entitled to issue a statutory demand for debts of $2,000 or more and the debtor company has 21 days to pay the debt to avoid the creditor commencing winding up proceedings. The temporary changes propose that, for a period of six months:

- The threshold for creditors issuing statutory demands be increased from $2,000 to $20,000; and

- The time frame for responding to a statutory demand (either by paying the amount demanded or making an application to set it aside) be increased from 21 days to six months.

Insolvent trading

Directors incur personal liability for debts incurred by a company if they trade the company whilst it is insolvent. Under the Corporations Act 2001 (Cth), directors have a duty to prevent insolvent trading. As a result, directors may be quick to make decisions to place the company into voluntary administration or liquidation when there is a risk of insolvency.

The changes announced are focussed on ensuring that companies have the confidence to trade during this challenging period. As a result, the temporary changes propose to relieve directors of personal liability for a period of six months while trading insolvent for debts incurred in the ordinary course of business.

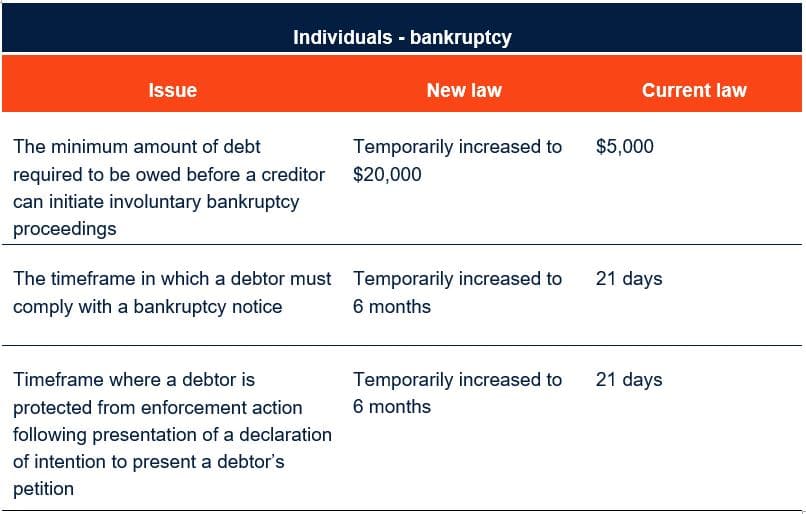

individuals

A common way of entering bankruptcy is by failure to comply with a bankruptcy notice. Individuals who do not comply with bankruptcy notices for debts of $5,000 or more face the likelihood of bankruptcy proceedings. Creditors are entitled to issue bankruptcy notices for debts of $5,000 or more.

Debtors also become bankrupt voluntarily. When a debtor makes a declaration of intention to present a debtor’s petition, there is a grace period of 21 days when unsecured creditors cannot take further action to recover debts.

The proposed temporary measures foreshadow changes to the Bankruptcy Act 1966 (Cth) for a period of six months where:

- The minimum amount of debt required to issue a bankruptcy notice be increased from $5,000 to $20,000;

- The timeframe for responding to a bankruptcy notice (either by paying the amount demanded or making an application to set it aside) will also increase from 21 days to six months; and

- The grace period when an individual presents a declaration of intention to present a debtor’s petition is extended from 21 days to six months.

Separately, it is also foreshadowed that the ATO will tailor solutions for businesses faced with financial difficulties as a result of COVID-19 by temporarily reducing payments and withholding enforcement action such as issuing Director Penalty Notices and commencing winding up proceedings.

Macpherson Kelley’s team of Insolvency lawyers will continue to monitor the changes in insolvency laws and provide further updates when new information is at hand. If you are experiencing difficulties in your business and/or as a director, please contact us.

The information contained in this article is general in nature and cannot be relied on as legal advice nor does it create an engagement. Please contact one of our lawyers listed above for advice about your specific situation.

more

insights

Voluntary dealings with regulators: Practical insights, tips & traps for agribusinesses

A change of director can trigger landholder duty says Victorian Supreme Court

Clarifying the boundaries of trade mark defences: The Fanatics case as a cautionary tale

stay up to date with our news & insights

Temporary Changes to Insolvency Laws: Australian Government Addresses Financial Distress for Businesses from COVID-19

On 22 March 2020, the Australian Federal Government announced a raft of proposed temporary changes to insolvency laws in light of the financial distress and challenges COVID-19 has caused to Australian businesses.

The proposed changes are summarised below:

companies

Statutory demands

One of the most common ways for companies to be wound up stems from non-compliance with a statutory demand. Creditors are entitled to issue a statutory demand for debts of $2,000 or more and the debtor company has 21 days to pay the debt to avoid the creditor commencing winding up proceedings. The temporary changes propose that, for a period of six months:

- The threshold for creditors issuing statutory demands be increased from $2,000 to $20,000; and

- The time frame for responding to a statutory demand (either by paying the amount demanded or making an application to set it aside) be increased from 21 days to six months.

Insolvent trading

Directors incur personal liability for debts incurred by a company if they trade the company whilst it is insolvent. Under the Corporations Act 2001 (Cth), directors have a duty to prevent insolvent trading. As a result, directors may be quick to make decisions to place the company into voluntary administration or liquidation when there is a risk of insolvency.

The changes announced are focussed on ensuring that companies have the confidence to trade during this challenging period. As a result, the temporary changes propose to relieve directors of personal liability for a period of six months while trading insolvent for debts incurred in the ordinary course of business.

individuals

A common way of entering bankruptcy is by failure to comply with a bankruptcy notice. Individuals who do not comply with bankruptcy notices for debts of $5,000 or more face the likelihood of bankruptcy proceedings. Creditors are entitled to issue bankruptcy notices for debts of $5,000 or more.

Debtors also become bankrupt voluntarily. When a debtor makes a declaration of intention to present a debtor’s petition, there is a grace period of 21 days when unsecured creditors cannot take further action to recover debts.

The proposed temporary measures foreshadow changes to the Bankruptcy Act 1966 (Cth) for a period of six months where:

- The minimum amount of debt required to issue a bankruptcy notice be increased from $5,000 to $20,000;

- The timeframe for responding to a bankruptcy notice (either by paying the amount demanded or making an application to set it aside) will also increase from 21 days to six months; and

- The grace period when an individual presents a declaration of intention to present a debtor’s petition is extended from 21 days to six months.

Separately, it is also foreshadowed that the ATO will tailor solutions for businesses faced with financial difficulties as a result of COVID-19 by temporarily reducing payments and withholding enforcement action such as issuing Director Penalty Notices and commencing winding up proceedings.

Macpherson Kelley’s team of Insolvency lawyers will continue to monitor the changes in insolvency laws and provide further updates when new information is at hand. If you are experiencing difficulties in your business and/or as a director, please contact us.