Trump’s tariffs cause trade pain for Australian & SE Asian businesses

In April 2025, President Donald Trump announced the implementation of global tariffs on goods entering the United States of America (USA), including categories such as clothing, footwear, accessories, and cosmetics. However, shipments valued under an aggregate fair market value of USD$800 (approximately $1,200 AUD), remained exempt from these tariffs, referred to as the de minimis exemption. The intention of the introduction of these tariffs was to incentivise international (and domestic) business to onshore production and manufacturing to the USA, thereby stimulating domestic employment and enhancing the manufacturing capabilities of the USA.

From 12:01 a.m. eastern daylight time on August 29, 2025, the de minimis exemption will cease and a tariff will need to be paid on all product sold to USA consumers for which the country of origin of the product isn’t the USA.

Country of origin

Under the current framework, tariffs are assessed based on the country of origin of the goods, irrespective of the country from which the product last left. For example, if you are an Australian business that has products manufactured in China, then the tariff is likely to be the Chinese tariff and not the Australian tariff.

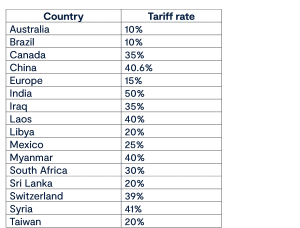

The table below details some of the country-specific tariff rates effective as at the date of this insight:

Penalties and additional tariffs for country of origin errors

Assessing the country of origin is not as straight forward as one may think, and there are certain exemptions or criteria that may apply to some products that enable a different country to be designated the country of origin. Additionally, if you engage in transhipping, or assert the incorrect country of origin, you may receive a penalty of an additional 40% tariff on top of the correct country tariff. For example, if you claimed the Australian tariff, but the Chinese tariff applied, then the business is liable to a tariff of 80.6% on each product and may also be fined or suffer further penalties under USA law.

Accordingly, we recommend seeking expert advice from an international trade lawyer who can help navigate these murky waters and ensure your products reach the USA without incurring penalties.

Shipping to the USA

It is evident there are considerably different tariffs applicable depending on the country of origin and this will pose significant issues for Australian businesses selling products to the USA. This is especially true if businesses source products from multiple countries or have arrangements with third party shipping providers. Several postal services, including Australia Post and DHL, have suspended shipments to the USA from Australia until they are able to implement a procedure to enable tariff collection from the sender prior to the goods entering the USA. As of writing, it is uncertain when Australia Post will resume its normal services to the USA.

Already, many Australian businesses have had to cease the sale of products to the USA as they can’t be delivered, or due to uncertainty around the payment of the tariffs.

On what basis is the tariff calculated?

Adding to the challenge faced by Australian businesses is that the tariff is applied on a per-product basis, calculated using the ‘Freight on Board’ (FOB) value. The FOB value is the actual retail sale price of the goods to the USA, and not the wholesale cost. Businesses should note that there are strategies that can be implemented to enable the tariff to be based on wholesale cost, for further information please contact our lawyers.

Who bears the cost?

Without the exemption, all shipments must now pass through U.S. Customs and Border Protection, potentially leading to longer delivery times and logistical complexity. Businesses will also need to decide whether to pass all or some of the tariff on to USA consumers via Delivery Duty Paid (DDP) or Delivered at Place (DAP) models, recalibrating margins, or adjusting retail pricing to maintain competitiveness. While this may seem a simple decision, the reality is that the tariffs are being used to gain a marketplace advantage for products originating in the USA. By passing on the tariff in full to the USA consumer, it may result in the products being too expensive (and a resulting decline in sales). On the other hand, absorbing some or all of the tariff by the business will reduce profit margins and may result in the sale to USA consumers being unprofitable.

The legal perspective on tariffs

The removal of the de minimis exemption is a disruption to businesses that export to the USA. At Macpherson Kelley, we are currently working closely with Australian businesses to help navigate the complexities of shifting global trade conditions, including exporting to the USA. Our experienced international trade team provides strategic guidance on export planning, tariff exposure, and compliance with international trade regulations.

If you require assistance with exporting to the USA, or any other trade issues, please contact Mark Metzeling or Kelly Dickson of Macpherson Kelley’s international trade team who will help you make informed decisions, mitigate risk, and protect your commercial interests.

The information contained in this article is general in nature and cannot be relied on as legal advice nor does it create an engagement. Please contact one of our lawyers listed above for advice about your specific situation.

more

insights

ASIC redacts officeholder data: What your business needs to know

Implied contract terms: Court of Appeal confirms no implied right for hospital to terminate long term emergency services agreement

Bunnings faces off against the Privacy Commissioner over facial recognition technology

stay up to date with our news & insights

Trump’s tariffs cause trade pain for Australian & SE Asian businesses

In April 2025, President Donald Trump announced the implementation of global tariffs on goods entering the United States of America (USA), including categories such as clothing, footwear, accessories, and cosmetics. However, shipments valued under an aggregate fair market value of USD$800 (approximately $1,200 AUD), remained exempt from these tariffs, referred to as the de minimis exemption. The intention of the introduction of these tariffs was to incentivise international (and domestic) business to onshore production and manufacturing to the USA, thereby stimulating domestic employment and enhancing the manufacturing capabilities of the USA.

From 12:01 a.m. eastern daylight time on August 29, 2025, the de minimis exemption will cease and a tariff will need to be paid on all product sold to USA consumers for which the country of origin of the product isn’t the USA.

Country of origin

Under the current framework, tariffs are assessed based on the country of origin of the goods, irrespective of the country from which the product last left. For example, if you are an Australian business that has products manufactured in China, then the tariff is likely to be the Chinese tariff and not the Australian tariff.

The table below details some of the country-specific tariff rates effective as at the date of this insight:

Penalties and additional tariffs for country of origin errors

Assessing the country of origin is not as straight forward as one may think, and there are certain exemptions or criteria that may apply to some products that enable a different country to be designated the country of origin. Additionally, if you engage in transhipping, or assert the incorrect country of origin, you may receive a penalty of an additional 40% tariff on top of the correct country tariff. For example, if you claimed the Australian tariff, but the Chinese tariff applied, then the business is liable to a tariff of 80.6% on each product and may also be fined or suffer further penalties under USA law.

Accordingly, we recommend seeking expert advice from an international trade lawyer who can help navigate these murky waters and ensure your products reach the USA without incurring penalties.

Shipping to the USA

It is evident there are considerably different tariffs applicable depending on the country of origin and this will pose significant issues for Australian businesses selling products to the USA. This is especially true if businesses source products from multiple countries or have arrangements with third party shipping providers. Several postal services, including Australia Post and DHL, have suspended shipments to the USA from Australia until they are able to implement a procedure to enable tariff collection from the sender prior to the goods entering the USA. As of writing, it is uncertain when Australia Post will resume its normal services to the USA.

Already, many Australian businesses have had to cease the sale of products to the USA as they can’t be delivered, or due to uncertainty around the payment of the tariffs.

On what basis is the tariff calculated?

Adding to the challenge faced by Australian businesses is that the tariff is applied on a per-product basis, calculated using the ‘Freight on Board’ (FOB) value. The FOB value is the actual retail sale price of the goods to the USA, and not the wholesale cost. Businesses should note that there are strategies that can be implemented to enable the tariff to be based on wholesale cost, for further information please contact our lawyers.

Who bears the cost?

Without the exemption, all shipments must now pass through U.S. Customs and Border Protection, potentially leading to longer delivery times and logistical complexity. Businesses will also need to decide whether to pass all or some of the tariff on to USA consumers via Delivery Duty Paid (DDP) or Delivered at Place (DAP) models, recalibrating margins, or adjusting retail pricing to maintain competitiveness. While this may seem a simple decision, the reality is that the tariffs are being used to gain a marketplace advantage for products originating in the USA. By passing on the tariff in full to the USA consumer, it may result in the products being too expensive (and a resulting decline in sales). On the other hand, absorbing some or all of the tariff by the business will reduce profit margins and may result in the sale to USA consumers being unprofitable.

The legal perspective on tariffs

The removal of the de minimis exemption is a disruption to businesses that export to the USA. At Macpherson Kelley, we are currently working closely with Australian businesses to help navigate the complexities of shifting global trade conditions, including exporting to the USA. Our experienced international trade team provides strategic guidance on export planning, tariff exposure, and compliance with international trade regulations.

If you require assistance with exporting to the USA, or any other trade issues, please contact Mark Metzeling or Kelly Dickson of Macpherson Kelley’s international trade team who will help you make informed decisions, mitigate risk, and protect your commercial interests.