Australian new merger regulation: The regime, recent amendments and announcements

The Treasury Laws Amendment (Mergers and Acquisitions Reform) Act 2024 (the Act) was passed on 28 November 2024, marking major changes to Australia’s merger clearance system. The Australian Competition and Consumer Commission (ACCC) Chair, Gina Cass-Gottlieb, then stated that the adoption of the Act “mark[ed] the most significant change to Australia’s merger regime since the Trade Practices Act was enacted 50 years ago” as it reformed Australia’s merger laws by introducing a mandatory and suspensory regime of merger control.

To complement the Act, the Australian Government further published the Competition and Consumer (Notification of Acquisitions) Determination 2025 (Determination) on 24 June 2025, and the ACCC published its Merger Assessment Guidelines, interim Merger Process Guidelines and quick guide for business (the Guidelines). Such publications provide guides to the notification thresholds, process and fees in respect of acquisitions.

Recently, the Government also announced some further refinements relating to the exemptions to this mandatory disclosure regime.

With such a monumental change to the process, there is much to wrap your head around if your business is considering a merger or acquisition. Highlighting the latest updates and providing an overview of the regime, our team of Competition and M&A lawyers will discuss the fundamental changes introduced by the Act, Determination and Guidelines, how these will be considered under Australian competition law, and how the changes may affect your business. Most relevantly, we also offer an update on the most recent announcement by the Government and what further changes may be on the horizon in 2026.

Adjustments to the legislation from previous proposals

In September 2024, we wrote an article contemplating the proposed regime changes evident in the consultation paper circulated by the Treasury. Whilst the majority of the passed legislation reflects the consultation paper, there have also been several adjustments.

With further refinements on the agenda in 2026, below is the most up-to-date information as of November 2025.

Starting dates and transitional arrangements

The start dates and transitional arrangement dates of the updated merger process are as follows:

1 July 2025 – 31 December 2025: During this transitional period, merging parties can choose to voluntarily notify the ACCC of their acquisition under the new regime. The current formal merger authorisation process with the ACCC will stay in place until 31 December 2025, but merging parties can only lodge applications for this process up until 30 June 2025. The current informal process of notification can also be used during the transitional period.

1 January 2026: This is the official start date of the new regime. From this date, if a proposed transaction is deemed notifiable, then it will need to be cleared by the ACCC.

Transitional period considerations

If merging parties have not put the acquisition into effect during the transitional period, the ACCC will need to be re-notified (after 1 January 2026) under the new regime. Similarly, if the ACCC has not granted informal clearance or made a merger authorisation decision by 31 December 2025, the ACCC will need to be re-notified of the proposed acquisition. In practice, this means merger parties seeking voluntary clearance in the second half of 2025 should notify the ACCC under the new regime to avoid having to re-notify if clearance is not granted before 1 January 2026.

New thresholds

The current regime is based on market share thresholds when considering if merger approval ought to be notified, although notification is still voluntary.

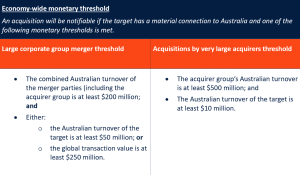

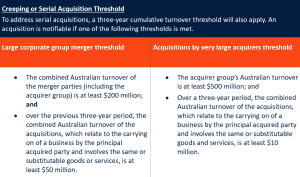

Defining the market and knowing market shares has often led to uncertainty and argument. So now, the Government has introduced the following simplified turnover and/or transaction value thresholds.

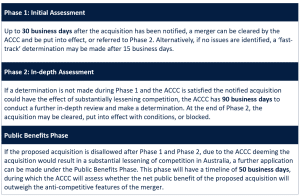

ACCC timelines for deals

The legislation sets out review timeframes within which the ACCC must make a determination on notified acquisitions. The timeline is as follows:

Extensions of Time

The legislation enables the ACCC to extend the above periods under certain conditions, namely:

- If the ACCC has issued a Section 155 Notice (broadly requiring a party to provide information, produce documents, or attend examination) and the party takes longer than 10 business days to respond to the notice, the ACCC can ‘stop the clock’ within any of the above phases until the requests for information or misleading notifications are complied with or rectified.

- Extending the determination period by the number of days after the due date that the notifying party responds to a request for information.

- Extending the determination period by no more than 15 days to consider a commitment or undertaking offered by the notifying party.

- Adjusting the notification date if the ACCC becomes aware of a material change of fact, with the determination then required to be made ‘within a reasonable period’ after the ACCC identifies that change.

- A request for an extension being submitted by the parties to the acquisition and the ACCC accepting the request.

The ACCC has expressed that it expects ‘about 80% of mergers will be cleared within 15-20 business days’. However, the expansive flexibility bestowed upon the statutory timeframes by the extensions of time, particularly the ACCC’s power to ‘stop the clock’, partially undermines the certainty intended to be conferred by the legislation and its timeframes.

Level of disclosure required to be provided to ACCC

Notification of Proposed Acquisition forms must be completed and submitted by the parties to the ACCC by email.

Notification of Proposed Acquisition forms outline the details of the merger including, but not limited to:

- the parties’ details

- industry

- proposed transaction, and

- consideration.

The ACCC has also provided short forms for straightforward acquisitions that are unlikely to raise competition concerns, and long forms for more complex acquisitions.

The ACCC has stated that they are committed to treating confidential information responsibly and in accordance with the law. The ACCC will review ways to limit disclosure, taking into consideration the interests of the affected person, public interest in disclosure and transparency of decision-making and the ACCC’s duties and functions within the merger control regime.

Additionally, the Act, Determination and Guidelines seek to provide improved clarity regarding the timing for the ACCC’s information gathering powers. They also confirm the ACCC’s non-compulsory powers to, firstly, request information (by inviting interested persons to make written submissions), secondly, request additional information in general, and, lastly, consult with reasonable and appropriate persons for the purposes of making a determination.

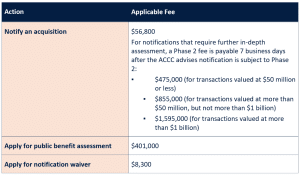

Fees

All notifiable transactions will attract a filing fee (with some exceptions for small businesses). The ACCC has released the following fees for 2025-26:

Small businesses that have an aggregated turnover of less than AUD $10 million may be eligible for a fee exemption. Such an exemption may apply where:

- only one notifying party of the acquisition is a small business entity for the income year that includes the contract date; or

- all notifying parties are small business entities for the income year that includes the contract date.

Recent announcement on exemptions

On 15 October 2025, the Assistant Minister Dr Andrew Leigh announced refinements to the initial notification requirements for the merger regime. These changes introduce new and broader exemptions from mandatory notification for certain low-risk business activities in areas such as residential property development, retail trade and financial markets.

Specifically, the changes include:

- Exempting leases and other acquisitions of interest in land in the ordinary course of business, unless subject to targeted notification requirements.

- Simplifying the approach to monetary thresholds for asset acquisitions.

- Streamlining notification obligations around serial acquisitions.

- Clarifying and expanding existing exemptions applicable to financial market activities.

These amendments are expected to be implemented through subordinate legislation before the mandatory regime commences on 1 January 2026.

How can our Competition and M&A lawyers help

The implementation of the Act, the Determination and the Guidelines represents an improvement on previously tabled proposals and is a watershed moment in the history of Australian Competition law. However, concerns remain regarding whether the new regime will capture significantly more deals, whether it will, on average, increase ACCC review time, and whether it will, particularly at first, increase upfront workload and complexity of seeking ACCC clearance for merging parties.

However, as anticipated by the 15 October 2025 announcement, further amendments are expected as the Government continues to work with stakeholders and the ACCC on the detailed design of the merger regime ahead of its official commencement on 1 January 2026. We will continue to keep you updated as these refinements are introduced.

If you would like to discuss the legislation and its potential impact on your impending transaction, please get in touch with our Competition and M&A lawyers and if any questions on the new merger regime or competition law, more generally, please contact Paul Kirton, Kelly Dickson or Scott Fitzgibbon from the Trade & Competition team.

The information contained in this article is general in nature and cannot be relied on as legal advice nor does it create an engagement. Please contact one of our lawyers listed above for advice about your specific situation.

more

insights

ASIC redacts officeholder data: What your business needs to know

Implied contract terms: Court of Appeal confirms no implied right for hospital to terminate long term emergency services agreement

Bunnings faces off against the Privacy Commissioner over facial recognition technology

stay up to date with our news & insights

Australian new merger regulation: The regime, recent amendments and announcements

The Treasury Laws Amendment (Mergers and Acquisitions Reform) Act 2024 (the Act) was passed on 28 November 2024, marking major changes to Australia’s merger clearance system. The Australian Competition and Consumer Commission (ACCC) Chair, Gina Cass-Gottlieb, then stated that the adoption of the Act “mark[ed] the most significant change to Australia’s merger regime since the Trade Practices Act was enacted 50 years ago” as it reformed Australia’s merger laws by introducing a mandatory and suspensory regime of merger control.

To complement the Act, the Australian Government further published the Competition and Consumer (Notification of Acquisitions) Determination 2025 (Determination) on 24 June 2025, and the ACCC published its Merger Assessment Guidelines, interim Merger Process Guidelines and quick guide for business (the Guidelines). Such publications provide guides to the notification thresholds, process and fees in respect of acquisitions.

Recently, the Government also announced some further refinements relating to the exemptions to this mandatory disclosure regime.

With such a monumental change to the process, there is much to wrap your head around if your business is considering a merger or acquisition. Highlighting the latest updates and providing an overview of the regime, our team of Competition and M&A lawyers will discuss the fundamental changes introduced by the Act, Determination and Guidelines, how these will be considered under Australian competition law, and how the changes may affect your business. Most relevantly, we also offer an update on the most recent announcement by the Government and what further changes may be on the horizon in 2026.

Adjustments to the legislation from previous proposals

In September 2024, we wrote an article contemplating the proposed regime changes evident in the consultation paper circulated by the Treasury. Whilst the majority of the passed legislation reflects the consultation paper, there have also been several adjustments.

With further refinements on the agenda in 2026, below is the most up-to-date information as of November 2025.

Starting dates and transitional arrangements

The start dates and transitional arrangement dates of the updated merger process are as follows:

1 July 2025 – 31 December 2025: During this transitional period, merging parties can choose to voluntarily notify the ACCC of their acquisition under the new regime. The current formal merger authorisation process with the ACCC will stay in place until 31 December 2025, but merging parties can only lodge applications for this process up until 30 June 2025. The current informal process of notification can also be used during the transitional period.

1 January 2026: This is the official start date of the new regime. From this date, if a proposed transaction is deemed notifiable, then it will need to be cleared by the ACCC.

Transitional period considerations

If merging parties have not put the acquisition into effect during the transitional period, the ACCC will need to be re-notified (after 1 January 2026) under the new regime. Similarly, if the ACCC has not granted informal clearance or made a merger authorisation decision by 31 December 2025, the ACCC will need to be re-notified of the proposed acquisition. In practice, this means merger parties seeking voluntary clearance in the second half of 2025 should notify the ACCC under the new regime to avoid having to re-notify if clearance is not granted before 1 January 2026.

New thresholds

The current regime is based on market share thresholds when considering if merger approval ought to be notified, although notification is still voluntary.

Defining the market and knowing market shares has often led to uncertainty and argument. So now, the Government has introduced the following simplified turnover and/or transaction value thresholds.

ACCC timelines for deals

The legislation sets out review timeframes within which the ACCC must make a determination on notified acquisitions. The timeline is as follows:

Extensions of Time

The legislation enables the ACCC to extend the above periods under certain conditions, namely:

- If the ACCC has issued a Section 155 Notice (broadly requiring a party to provide information, produce documents, or attend examination) and the party takes longer than 10 business days to respond to the notice, the ACCC can ‘stop the clock’ within any of the above phases until the requests for information or misleading notifications are complied with or rectified.

- Extending the determination period by the number of days after the due date that the notifying party responds to a request for information.

- Extending the determination period by no more than 15 days to consider a commitment or undertaking offered by the notifying party.

- Adjusting the notification date if the ACCC becomes aware of a material change of fact, with the determination then required to be made ‘within a reasonable period’ after the ACCC identifies that change.

- A request for an extension being submitted by the parties to the acquisition and the ACCC accepting the request.

The ACCC has expressed that it expects ‘about 80% of mergers will be cleared within 15-20 business days’. However, the expansive flexibility bestowed upon the statutory timeframes by the extensions of time, particularly the ACCC’s power to ‘stop the clock’, partially undermines the certainty intended to be conferred by the legislation and its timeframes.

Level of disclosure required to be provided to ACCC

Notification of Proposed Acquisition forms must be completed and submitted by the parties to the ACCC by email.

Notification of Proposed Acquisition forms outline the details of the merger including, but not limited to:

- the parties’ details

- industry

- proposed transaction, and

- consideration.

The ACCC has also provided short forms for straightforward acquisitions that are unlikely to raise competition concerns, and long forms for more complex acquisitions.

The ACCC has stated that they are committed to treating confidential information responsibly and in accordance with the law. The ACCC will review ways to limit disclosure, taking into consideration the interests of the affected person, public interest in disclosure and transparency of decision-making and the ACCC’s duties and functions within the merger control regime.

Additionally, the Act, Determination and Guidelines seek to provide improved clarity regarding the timing for the ACCC’s information gathering powers. They also confirm the ACCC’s non-compulsory powers to, firstly, request information (by inviting interested persons to make written submissions), secondly, request additional information in general, and, lastly, consult with reasonable and appropriate persons for the purposes of making a determination.

Fees

All notifiable transactions will attract a filing fee (with some exceptions for small businesses). The ACCC has released the following fees for 2025-26:

Small businesses that have an aggregated turnover of less than AUD $10 million may be eligible for a fee exemption. Such an exemption may apply where:

- only one notifying party of the acquisition is a small business entity for the income year that includes the contract date; or

- all notifying parties are small business entities for the income year that includes the contract date.

Recent announcement on exemptions

On 15 October 2025, the Assistant Minister Dr Andrew Leigh announced refinements to the initial notification requirements for the merger regime. These changes introduce new and broader exemptions from mandatory notification for certain low-risk business activities in areas such as residential property development, retail trade and financial markets.

Specifically, the changes include:

- Exempting leases and other acquisitions of interest in land in the ordinary course of business, unless subject to targeted notification requirements.

- Simplifying the approach to monetary thresholds for asset acquisitions.

- Streamlining notification obligations around serial acquisitions.

- Clarifying and expanding existing exemptions applicable to financial market activities.

These amendments are expected to be implemented through subordinate legislation before the mandatory regime commences on 1 January 2026.

How can our Competition and M&A lawyers help

The implementation of the Act, the Determination and the Guidelines represents an improvement on previously tabled proposals and is a watershed moment in the history of Australian Competition law. However, concerns remain regarding whether the new regime will capture significantly more deals, whether it will, on average, increase ACCC review time, and whether it will, particularly at first, increase upfront workload and complexity of seeking ACCC clearance for merging parties.

However, as anticipated by the 15 October 2025 announcement, further amendments are expected as the Government continues to work with stakeholders and the ACCC on the detailed design of the merger regime ahead of its official commencement on 1 January 2026. We will continue to keep you updated as these refinements are introduced.

If you would like to discuss the legislation and its potential impact on your impending transaction, please get in touch with our Competition and M&A lawyers and if any questions on the new merger regime or competition law, more generally, please contact Paul Kirton, Kelly Dickson or Scott Fitzgibbon from the Trade & Competition team.